Loud Budgeting: The Gen Z Financial Revolution (Tori Dunlap and Ramit Sethi Approved)

Hey there, fellow broke millennials and Gen Z-ers! Feeling like your bank account is emptier than your DMs? Don't worry, we've all been there. Let's talk about the hottest trend since TikTok dances: Loud Budgeting. It's like shouting your financial goals from the rooftops, but instead of your neighbors calling the cops, they'll be sliding into your DMs for money advice.

What's the Deal with Loud Budgeting?

Before we dive into the juicy details, let's break down why your current financial situation probably sucks more than that "let's grab coffee sometime" text from your ex:

- Student Loans: The gift that keeps on taking. You thought that degree would lead to a corner office, but here you are, working from the corner of your bedroom.

- Credit Card Debt: Remember that time you said "YOLO" and splurged on a full-price Coachella ticket? Yeah, your credit score remembers too.

- Impulse Purchases: Those late-night online shopping sprees seemed like a good idea at the time, right?

The impact? It's not just about the money, fam:

- Mental Health: Constant anxiety about checking your bank account is not the vibe.

- Life Goals: Want to move out, travel the world, or start that podcast empire? Your empty wallet is standing in your way like a bouncer at an exclusive club.

- Future You: While you're struggling to make minimum payments, your retirement savings are looking as empty as your fridge after a weekend binge.

Enter Loud Budgeting: Your Financial Glow-Up Awaits

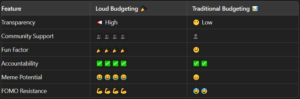

Okay, so what's this Loud Budgeting thing that Tori Dunlap and Ramit Sethi are raving about? It's not a new budgeting app (although maybe it should be). Loud Budgeting is all about being open and proud about your financial habits and boundaries. It's like Marie Kondo-ing your finances, but instead of asking if things spark joy, we're asking if they're worth the #MoneySelfie.

Here's the tea, straight from the financial influencer gospel:

- Get real with yourself about your money situation.

- Set some goals that aren't just "become a billionaire overnight."

- Create a budget that doesn't make you want to cry.

- Tell the world about it like you're announcing your relationship status change.

It's like playing a video game, but instead of defeating bosses, you're crushing financial goals. Level up!

Loud Budgeting: A Step-by-Step Guide for the Financially Challenged

Let's break down this financial flex:

- Get Organized: List your income, debts, and expenses like you're planning the guest list for the most exclusive party ever.

- Set Some Goals: Want to save for a trip? Pay off that credit card? Buy a house before you're 80? Write it down and make it Instagram official.

- Budget Like a Boss: Create a spending plan that doesn't make you want to ugly cry. Remember, it's about progress, not perfection.

- Shout It Out: Share your goals on social media. It's like meal prep posts, but for your wallet.

- Find Your Money Squad: Join online communities or start a finance club with your friends. It's like a book club, but instead of pretending to read, you're pretending to understand crypto.

Pro Tips from the Money Mavens: Tori Dunlap and Ramit Sethi

Tori Dunlap and Ramit Sethi are like the cool older siblings of finance. Here's what they'd tell you over oat milk lattes:

- Consistency is Key: Treat your budget like your skincare routine – do it religiously.

- Knowledge is Power: Understand your finances like you understand memes. Know those interest rates!

- Track That Progress: Use apps to visualize your savings growing. It's as satisfying as watching your TikTok followers increase.

- Community is Everything: Share your wins and setbacks. Your followers are there for the journey, not just the highlight reel.

Real People, Real Success: #LoudBudgeting Stories

Let's look at some folks who crushed it with Loud Budgeting, making Tori and Ramit proud:

Alex's Glow-Up: Saved $10K in a year by meal prepping and starting a side hustle selling vintage finds on Depop. Documented the whole journey on Instagram.

Jordan's Debt-Free Dream: Paid off student loans in three years by living with roommates and turning their dog-walking gig into a full-fledged pet-sitting empire on Rover. Shared weekly updates on TikTok.

Gamify Your Finances: Tori Dunlap Meets Fortnite

Make budgeting as addictive as scrolling through TikTok:

- Create Milestones: Set small goals and reward yourself (in budget-friendly ways) when you hit them.

- Visualize Progress: Use finance apps or create a visual chart. Watching that savings grow is oddly satisfying.

- Challenge Friends: Start a savings challenge with friends. First one to hit their goal gets treated to coffee (or a homemade Dalgona coffee, because we're saving money here).

Staying Motivated When the FOMO Hits

Let's be real – saving money while your friends are living it up on Instagram can be tough. Here's how to keep your eyes on the prize, Ramit Sethi style:

- Reframe Your Mindset: Think of budgeting as investing in your future self. Future you will be thanking present you for those sacrifices.

- Find Free Fun: Get creative with free activities. Nature hikes, free museum days, or hosting potluck game nights can be just as gram-worthy.

- Celebrate Small Wins: Saved $100? That's worth a celebration! Do a happy dance, post a humble brag, or treat yourself to a fancy coffee (but just one, Tori is watching!).

Beyond Budgeting: Building Your Financial Empire

Once you've mastered the art of Loud Budgeting, it's time to level up your money game. Here's what Tori and Ramit would want you to do next:

- Emergency Fund: Start building that safety net. Aim for 3-6 months of expenses.

- Invest in Yourself: Consider low-cost ways to boost your skills. Online courses, workshops, or certifications can increase your earning potential.

- Start Investing: Even small amounts in index funds or robo-advisors can grow over time. It's like planting seeds for your future money tree.

- Side Hustle: Keep that extra income flowing. Whether it's freelancing, selling crafts, or becoming a part-time influencer, diversify that income stream.

Drop the Mic: Final Thoughts

Loud Budgeting isn't just about flexing your savings account (although that's a nice perk). It's about taking control of your financial narrative and building the future you want. It's like being the main character in your own money movie, and honey, you're ready for your close-up.

Remember, every dollar saved is a step towards freedom. It might not be as instantly gratifying as getting likes on your latest post, but trust us, the long-term payoff is way better than any fleeting social media dopamine hit.

So, are you ready to get loud about your budget? Drop a comment, share your goals, or hit us up with your best money-saving memes. Let's turn those financial frowns upside down!

#LoudBudgeting #FinancialFreedom #GenZMoney #ToriDunlapApproved #RamitSethiSays