How to Dodge the Credit Card Debt Trap and Still Live Your Best Life 🚫💳💸

Yo, fellow Gen Z-ers! 📱✨ Did you know that the average millennial is out here carrying over $5K in credit card debt? Big yikes! 😬 But don't stress, fam. We're about to spill the tea on how to keep your finances on fleek without falling into the credit card trap. Whether you're just starting your adulting journey or you're already grinding in your career, this guide's got your back. Let's get this bread responsibly! 🍞💪

Credit Cards: BFF or Toxic Friend? 🤔

Credit cards can be your ride-or-die or your worst nightmare. It's all about how you use them. Let's break it down:

Credit Card 101: The Basics

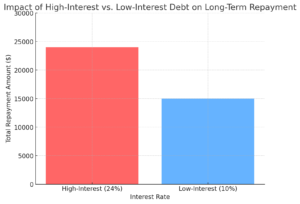

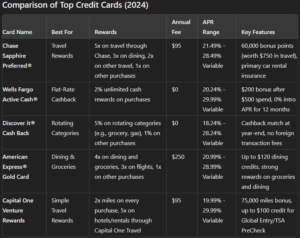

- APR (Annual Percentage Rate): This is the interest you'll pay if you don't clear your balance. If your card's APR is 20% and you're carrying a balance, you could end up paying hundreds or even thousands more than what you originally spent. Not cool, bro.

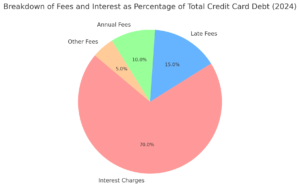

- Fees: Watch out for those sneaky fees – late fees, annual fees, and over-limit fees. They can add up faster than TikTok views on a viral dance challenge.

- Credit Limits: This is the max you can spend on your card. Go over it, and you're in for a bad time – penalties and a hit to your credit score. Oof.

Common Credit Card Traps (Don't Get Caught Slipping!)

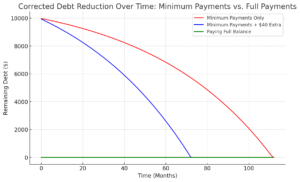

- Minimum Payments: Paying just the minimum each month? That's a trap. The rest of your balance is growing interest faster than your houseplants (if you're actually keeping them alive).

- Lifestyle Inflation: Getting that bag at your new job? Don't let your spending go wild just 'cause your credit limit went up. That's a one-way ticket to Debt City, population: you.

- Multiple Credit Cards: Having more cards than you can keep track of is like trying to watch all your TikTok FYP in one sitting – overwhelming and probably not great for your health.

Using Credit Cards Like a Boss 😎

Your credit card can be a power-up in your financial game if you know how to use it right.

Budgeting and Expense Tracking: Keep It 100

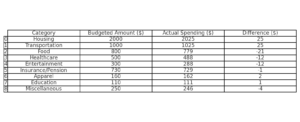

- Create a Budget: Allocate your coins for the essentials, the fun stuff, and savings. Make sure you've got room for those credit card payments – you want to pay them off in full each month, no cap.

- Track That Spend: Use apps like Mint, YNAB, or PocketGuard to keep an eye on where your money's going. It's like having a financial fitness tracker, but for your wallet.

Paying Off Balances: Don't Let That Interest Catch You Slipping

- Full Balance Payments: Pay off your whole balance every month. It's the ultimate flex – no interest charges, no debt accumulation. You're basically telling interest "Thank u, next."

- Debt Repayment Strategies: If you're already in the debt game, try the snowball method (paying off smallest debts first) or the avalanche method (highest interest rates first). Pick your fighter and stick to it.

Use Credit Cards for Necessities Only: Keep It Essential

- Stick to the Basics: Use your card for things you need, like groceries, gas, and bills. It's not for funding your entire Coachella experience or your Supreme merch addiction.

- The "Two-Week Rule": For non-essential purchases, wait two weeks before buying. If you still want it after that, maybe it's worth it. But probably not.

Build an Emergency Fund: Your Financial Safety Net

- Savings Goal: Aim to save enough to cover 3-6 months of living expenses. It's your "in case of emergency, break glass" fund, but for money.

- Automated Savings: Set up auto-transfers to your savings account every payday. It's like meal prepping, but for your bank account.

Avoiding Debt Traps: Don't Get Caught in the Web 🕸️

Even the most financially savvy can fall into debt traps. Here's how to stay woke:

Recognizing High-Interest Debt: The Silent Killer

- Interest Rates: Credit card interest rates can be higher than your screen time. We're talking 15% to over 30%. Carrying a balance on these is like setting your money on fire.

- Payoff Prioritization: Focus on paying down the high-interest debt first. It's like defeating the final boss in a video game – take out the biggest threat first.

Avoiding Cash Advances: The Ultimate No-No

- Fees and Immediate Interest: Cash advances are the Darth Vader of credit card features. High fees, immediate interest, and generally bad vibes. Avoid them like you avoid your ex's Instagram stories.

- Alternatives: Look into personal loans or use your emergency fund instead. They're usually less likely to wreck your financial future.

Being Cautious with 'Buy Now, Pay Later' Services: The New Kid on the Block

- Temptation to Overspend: BNPL services are like that friend who always convinces you to go out when you should be staying in. Convenient, but dangerous for your wallet.

- Debt Accumulation: Those small payments can add up faster than your unread emails. Always ask yourself if you really need it and if you can actually afford it.

- Read the Fine Print: Don't just scroll and accept. Actually read those terms and conditions. It's not as fun as reading your horoscope, but way more important.

Maximizing Credit Card Benefits Without the Debt Drama

You can still get those sweet, sweet credit card perks without drowning in debt. Here's how:

Choosing the Right Card: Pick Your Player

- Assess Your Needs: Look for cards that vibe with your spending habits and financial goals. Just starting out? Consider a student or secured credit card with no annual fee.

- Reward Programs: Choose a card with rewards that match your lifestyle. Whether it's cashback on groceries, points for travel, or discounts on your daily cold brew addiction.

Maximizing Rewards: Get Those Perks

- Responsible Spending: Use your card for regular expenses you'd be making anyway. It's like getting extra XP for tasks you were already doing in a game.

- Avoid Chasing Rewards: Don't spend more just to get rewards. If you wouldn't buy it without the rewards, it's probably not worth it. Don't play yourself.

Psychological and Behavioral Tips: Mind Over Money 🧠💰

Your mind is your most powerful tool in avoiding debt. Let's hack your brain for financial success:

Mindful Spending: Stay Woke with Your Wallet

- Wants vs. Needs: Before you buy something, ask yourself if it's a want or a need. It's like Marie Kondo-ing your spending habits.

- The 24-48 Hour Rule: Wait a day or two before making non-essential purchases. It's like letting your crush's text sit for a bit before replying – if you still want it after the wait, maybe it's worth it.

- Regular Reviews: Schedule financial check-ins with yourself. It's like having a DTR (Define The Relationship) talk, but with your money.

Managing Peer Pressure and Social Media Influence: Don't Let the FOMO Get You

- The Social Media Trap: Instagram and TikTok can make you feel like you need to ball out to keep up. Remember, it's all filters and good lighting.

- Stay Grounded: Focus on your own financial goals. Your future self will thank you more than your followers ever could.

- Set Boundaries: Maybe unfollow those accounts that make you want to spend. Follow some financial literacy accounts instead. It's like a social media cleanse, but for your wallet.

Level Up Your Money Game: Financial Education for the Win 🧠💰

Staying ahead in the money game is all about that continuous learning grind. Here's how to keep your financial knowledge fresh:

Become a Financial Content Junkie 🎧📚

- Learn on the Daily: Make consuming financial content your new guilty pleasure. Swap out some of your TikTok time for money tips. Whether it's podcasts during your commute, finance blogs while you're waiting for your latte, or books before bed – get that financial wisdom flowing!

- Knowledge is Your Superpower: The more you learn, the more confident you'll be flexing those money management muscles. It's like leveling up in a video game, but for your bank account. Debt traps? You'll be dodging them like Neo in The Matrix.

Financial Resources That Don't Suck 🔥

Ready to turn your brain into a money-making machine? Check out these fire resources that'll have you speaking fluent finance in no time:

Podcasts for Your Ears 🎙️

- The Stacking Benjamins Show: It's like hanging out with your hilarious, financially savvy friend. They cover everything from investing to saving, and it's so fun you'll forget you're learning. Perfect for when you're pretending to work out at the gym.

- Afford Anything: Hosted by Paula Pant, this podcast is your ticket to financial independence. It's like a cheat code for life, giving you the inside scoop on smart money moves, real estate investing, and designing a life that doesn't suck.

Blogs to Bookmark 💻

- Mr. Money Mustache: This blog is the OG of financial independence and frugal living. It's like your cool uncle who teaches you how to live your best life while stacking that paper. Practical advice that'll have you building wealth faster than you can say "avocado toast."

- Get Rich Slowly: For those of us who aren't about to win the lottery anytime soon, this blog is all about the slow and steady approach to getting that bag. Smart saving, investing tips, and financial planning that'll have you achieving financial freedom without feeling like you're living under a rock.

Books That Won't Put You to Sleep 📚

- "The Total Money Makeover" by Dave Ramsey: This isn't your grandpa's finance book. Dave Ramsey serves up a step-by-step guide to financial glow-ups with zero filter. It's perfect for anyone ready to take control of their financial destiny and tell debt to take a hike.

- "Your Money or Your Life" by Vicki Robin and Joe Dominguez: Want to transform your relationship with money faster than a Kardashian changes outfits? This book is your go-to. It's all about achieving that financial independence and living your best life. A must-read for anyone looking to zhuzh up their money mindset.

So there you have it, fam! With these resources in your arsenal, you'll be on your way to becoming a financial wizard faster than you can say "compound interest." Now go forth and get that bread! 🍞💸

Mental Health Impacts: It's Not Just About the Benjamins

Your relationship with credit cards can affect your mental health. Let's talk about it:

Positive Mental Health Impacts: The Good Vibes

- Financial Confidence: Successfully managing your credit card is a major flex. Watching your credit score go up is like leveling up in real life.

- Stress Reduction: Knowing you have a credit card for emergencies can be a real stress-buster. It's like having a financial security blanket.

Negative Mental Health Impacts: The Dark Side

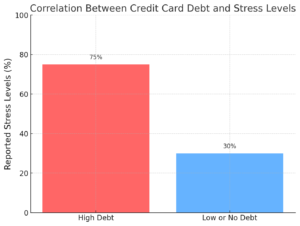

- Stress and Anxiety: Debt can be a major source of stress. It's like having a cloud of doom following you around.

- Guilt and Regret: Overspending can lead to some serious feels. It's the financial equivalent of texting your ex at 2 AM.

- Relationship Strain: Money problems can put a real damper on your relationships. It's like bringing a third wheel on all your dates, but the third wheel is debt.

Balancing Credit Card Use with Mental Well-being: Find Your Zen

- Mindful Spending: Practice mindful spending to avoid the emotional rollercoaster of debt.

- Seek Help When Needed: If you're feeling overwhelmed, don't be afraid to reach out. There are pros who can help you manage both your money and your mind.

- Regular Check-ins: Do mental health check-ins along with your financial ones. It's like checking your horoscope, but actually useful.

The Ultimate Financial Vibe Check 💸🧠

Yo, it's time for a financial vibe check! Use this checklist to see how your money sitch is messing with your mental health. It's like a mood ring, but for your wallet and your mind. Let's get introspective! 🤔💭

| Vibe Category | Check Yourself Before You Wreck Yourself |

|---|---|

| 💡 Stress-o-Meter |

|

| 🌈 Emotional Rollercoaster |

|

| 🔄 Stress-Busting Moves |

|

| 👥 Squad Goals Check |

|

| 💪 Body Check |

|

| 💼 Money Boss Status |

|

| 🔮 Future You Vibes |

|

| 🤝 Your Financial Fam |

|

Real-Life Examples: Learn from the OGs

Let's take a page from those who've been there, done that:

Success Stories

Emily's Strategy: The Budget Queen 👑

Background: Emily, mid-20s, avoided debt by budgeting like a boss.

Key Strategies:

- Budgeting: Used the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt).

- Paying Off Balances: Cleared credit card balances monthly like she was clearing her inbox.

- Debt Prioritization: Focused on those high-interest student loans like a laser.

- Emergency Fund: Built a 6-month cushion, because adulting is unpredictable.

- Rewards Cards: Used strategically for everyday purchases, racking up those points.

Outcome: Emily paid off her loans early and kept her finances healthier than her plant collection.

Mark's Debt-Free Journey: The Frugal Flexer 💪

Background: Mark, 29, resisted lifestyle inflation despite making bank.

Key Strategies:

- Debt Repayment: Tackled high-interest credit card debt first, like a financial ninja.

- Lifestyle Control: Lived modestly despite income increases. No flexing on the 'gram for him.

- Automated Savings: Set up auto-transfers for savings and debt. Set it and forget it, like your Spotify playlist.

- Smart Credit Use: Used cards for rewards, paying off balances monthly. No interest for this smart cookie.

- Emergency Fund: Built an 8-month reserve. He's ready for anything, even another toilet paper shortage.

Outcome: Mark became debt-free in two years and now uses credit cards like a pro.

You Got This! 🚀

Alright, squad, let's wrap this up. Your financial future is in your hands – don't let credit card debt cramp your style. By using these strategies, you can avoid the debt traps that many of us fall into. Take action today: check your credit card use, set some financial goals (maybe "save enough for a PS5 AND pay off my card"?), and start implementing these tips.

Remember, credit cards are a tool, not a ticket to YOLO spending. Use them wisely, and you'll be building a financial future so bright, you'll need shades. Now go forth and conquer, you financially savvy icon! 💯✨