How to Avoid the Credit Card Debt Trap as a Young Professional

Did you know that the average millennial carries over $5,000 in credit card debt? While credit cards offer convenience and rewards, they can quickly become a financial nightmare if not managed wisely. As a young professional, your financial decisions now will shape your future. The good news? With the right strategies, you can sidestep the pitfalls and take full control of your financial journey. This guide will show you how to navigate the complexities of credit card use, avoid common debt traps, and maintain both your financial and mental well-being.

Understanding Credit Cards: Friend or Foe?

Credit cards can be your best friend or your worst enemy. It all comes down to how well you understand their mechanics and risks. Here’s a breakdown of the essentials:

Credit Card Basics

Credit cards are a convenient tool for managing short-term finances and building credit, but they also come with significant risks:

- APR (Annual Percentage Rate): This is the interest rate charged on any unpaid balance. For example, if your credit card has an APR of 20% and you carry a balance, you could end up paying hundreds or even thousands more than your original purchase over time.

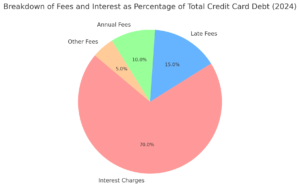

- Fees: Credit cards often come with various fees—late fees, annual fees, and fees for exceeding your credit limit. These can add up quickly and contribute to debt accumulation.

- Credit Limits: Your credit limit is the maximum amount you can borrow on your card. Exceeding this limit can result in penalties and negatively impact your credit score.

Common Pitfalls of Credit Card Use

Many young professionals fall into these traps:

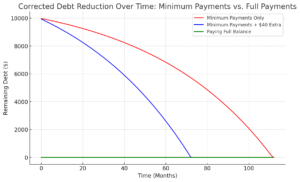

- Minimum Payments: Paying only the minimum amount due each month might seem like a way to stay on top of your finances, but it’s a trap. The remaining balance accrues interest, which can significantly increase the amount you owe over time.

- Lifestyle Inflation: As your income grows, so might your spending—especially if you rely on credit cards to fund a more luxurious lifestyle. This can lead to mounting debt that becomes harder to manage.

- Multiple Credit Cards: It’s easy to lose track of spending when you have multiple cards. This can lead to overspending and make it difficult to keep up with payments.

Smart Credit Card Usage: Wield Your Power Wisely

Your credit card is a powerful tool—if you know how to wield it wisely.Using credit cards strategically rather than impulsively can make all the difference in avoiding debt.

Budgeting and Tracking Expenses

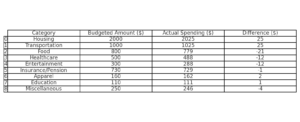

Creating and sticking to a budget is crucial for managing credit card use:

- Budget Creation: Allocate specific amounts for essential expenses, discretionary spending, and savings. Your budget should include a line item for credit card payments, ensuring you don’t exceed what you can afford to pay off in full each month.

- Expense Tracking: Apps like Mint, YNAB (You Need A Budget), and PocketGuard help you monitor your spending in real-time. Regularly reviewing your spending helps you stay within budget and avoid surprise balances on your credit card statement.

Paying Off Balances

To avoid the credit card debt trap, it’s essential to pay off your balance in full every month:

- Full Balance Payments: Paying off your full balance each month prevents interest charges from accumulating. It’s a simple yet powerful habit that can save you hundreds in interest over the long term.

- Debt Repayment Strategies: If you’re already in debt, consider the snowball method (paying off the smallest debts first) to gain quick wins and build momentum. Alternatively, the avalanche method (paying off debts with the highest interest rates first) can save you the most money in the long run.

Use Credit Cards for Necessities Only

One of the best ways to avoid debt is to use credit cards only for essential purchases:

- Necessities: Limit your credit card use to necessary expenses like groceries, gas, and utility bills. This helps you keep spending under control and ensures that you can pay off your balance each month.

- The “Two-Week Rule”: For non-essential purchases, wait two weeks before buying. This delay helps curb impulse buying and gives you time to determine whether the purchase is truly necessary.

Build an Emergency Fund

An emergency fund is your financial safety net:

- Savings Goal: Aim to save three to six months’ worth of living expenses. This fund ensures that you don’t have to rely on credit cards to cover unexpected expenses, like car repairs or medical bills.

- Automated Savings: Set up automatic transfers to your savings account each payday. This helps you build your emergency fund consistently without having to think about it.

Avoiding Debt Traps: Don’t Get Caught

The path to debt is paved with good intentions.Even the most financially savvy can fall into debt traps. Here’s how to steer clear:

Recognizing High-Interest Debt

Carrying balances on high-interest credit cards is a fast track to financial trouble:

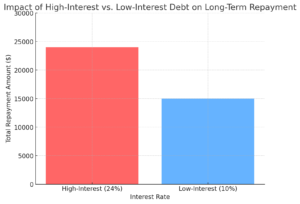

- Interest Rates: Credit card interest rates can range from 15% to over 30%. Carrying a balance on high-interest cards can quickly inflate your debt, making it harder to pay off.

- Payoff Prioritization: Focus on paying down high-interest debt first. Use the avalanche method to tackle the most expensive debt, which will save you the most money over time.

Avoiding Cash Advances

Cash advances are one of the most expensive forms of credit:

- Fees and Immediate Interest: Cash advances typically come with high fees and start accruing interest immediately—often at a higher rate than regular purchases. Avoid them whenever possible.

- Alternatives: Instead of taking a cash advance, consider personal loans or using your emergency fund. These options usually have lower interest rates and more favorable terms.

Visual Aid: A comparison chart showing the costs associated with cash advances versus other borrowing options like personal loans.

Being Cautious with 'Buy Now, Pay Later' Services

“Buy Now, Pay Later” (BNPL) services are growing in popularity, but they come with risks:

- Temptation to Overspend: BNPL services make it easy to buy now and pay later, but this convenience can lead to overspending and accumulating debt across multiple platforms.

- Debt Accumulation: Small, manageable payments can add up quickly if you’re not careful. Always consider whether you truly need the item and if you can afford to pay for it in full.

- Read the Fine Print: Be aware of the terms and conditions, including any late fees or penalties for missed payments.

Visual Aid: An infographic highlighting the risks of BNPL services and tips for using them responsibly.

Maximizing Credit Card Benefits Without Accumulating Debt

Credit cards don’t have to be a debt sentence. When used strategically, they can offer valuable rewards and benefits without leading you into debt.

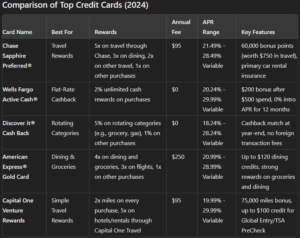

Choosing the Right Card

Selecting the right credit card is the first step toward responsible credit use:

- Assess Your Needs: Look for cards that align with your spending habits and financial goals. If you’re just starting out, consider a student or secured credit card with no annual fee.

- Reward Programs: Choose a card with rewards that match your lifestyle—whether it’s cashback on groceries, points for travel, or discounts on everyday purchases. Avoid cards with high annual fees unless the benefits significantly outweigh the costs.

Maximizing Rewards

Credit card rewards can be a great benefit, but only if you’re not paying interest on them:

- Responsible Spending: Use your credit card for regular expenses you’d be making anyway, like gas and groceries. Pay off the balance in full each month to avoid interest charges.

- Avoid Chasing Rewards: Don’t fall into the trap of overspending just to earn rewards. If you wouldn’t buy it without the rewards, it’s probably not worth it.

Psychological and Behavioral Tips: Master Your Mindset

Your mind is the most powerful tool in avoiding debt.Understanding the psychology behind spending can help you stay in control of your finances.

Mindful Spending

Mindful spending is about being intentional with your money:

- Distinguish Wants from Needs: Before making a purchase, ask yourself if it’s a want or a need. This simple practice can prevent unnecessary spending.

- The 24-48 Hour Rule: Wait 24-48 hours before making any non-essential purchase. This gives you time to reflect on whether the purchase is truly necessary or just an impulse.

- Regular Reviews: Schedule regular check-ins with yourself to review your spending habits. Adjust your budget and goals as needed.

Mindful Spending Checklist

Before making any purchase, pause and reflect with these essential questions to ensure you're making wise financial choices:

Managing Peer Pressure and Social Media Influence

Social media can be a major driver of impulse spending:

- The Social Media Trap: Platforms like Instagram and TikTok often showcase curated, idealized versions of life that can make you feel like you need to spend more to keep up.

- Stay Grounded: Remember that social media often shows only the highlights, not the full picture. Focus on your financial goals and what’s important to you, rather than trying to keep up with others.

- Set Boundaries: Consider limiting your exposure to social media or following accounts that promote financial wellness instead of consumerism.

Continuous Financial Education

Ongoing financial education is key to staying ahead:

- Learn Continuously: Make a habit of consuming financial content regularly. This could be through podcasts, blogs, or books focused on personal finance.

- Empower Yourself: The more you learn, the more confident you’ll be in managing your money and avoiding debt traps. Knowledge is power, especially when it comes to financial decision-making.

Recommended Financial Resources

Enhance your financial knowledge with these handpicked resources, including insightful podcasts, blogs, and books. Whether you're just starting your financial journey or looking to deepen your understanding, these resources offer valuable guidance.

Podcasts

- The Stacking Benjamins Show

A light-hearted podcast that covers a wide range of financial topics, from investing to saving strategies. With expert guest interviews, it’s perfect for anyone looking to gain financial wisdom in a fun and engaging way. - Afford Anything

Hosted by Paula Pant, this podcast explores the concept of financial independence and provides actionable tips on smart money decisions, real estate investing, and lifestyle design.

Blogs

- Mr. Money Mustache

Dive into the world of financial independence and frugality with Mr. Money Mustache. This blog offers practical advice on how to live a more efficient and purposeful life while building wealth. - Get Rich Slowly

Focused on the gradual approach to wealth building, this blog provides insightful articles on smart saving, investing, and financial planning, helping readers achieve financial freedom at their own pace.

Books

- “The Total Money Makeover” by Dave Ramsey

A step-by-step guide to financial fitness, offering practical advice on getting out of debt and building wealth. Dave Ramsey’s no-nonsense approach is ideal for anyone looking to take control of their financial future. - "Your Money or Your Life” by Vicki Robin and Joe Dominguez

This book is a comprehensive guide to transforming your relationship with money, achieving financial independence, and living more intentionally. It’s a must-read for those looking to rethink their financial habits.

Mental Health Impacts of Credit Card Use: The Good and the Bad

Credit card debt doesn’t just affect your wallet—it can take a toll on your mental health.Understanding these impacts can help you make better financial choices.

Positive Mental Health Impacts

Using credit cards responsibly can actually benefit your mental health:

- Financial Confidence: Successfully managing your credit card builds self-esteem and confidence in your financial abilities. It’s empowering to see your credit score rise and know that you’re in control.

- Stress Reduction: Knowing that you have a credit card as a backup for emergencies can reduce anxiety. It’s a safety net that can give you peace of mind in uncertain situations.

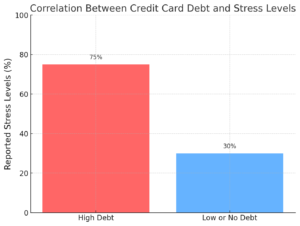

Negative Mental Health Impacts

On the flip side, credit card debt can have serious negative effects on your mental health:

- Stress and Anxiety: Debt can be a major source of stress, leading to anxiety and even depression. The constant worry about how to make payments or how much interest is accruing can be overwhelming.

- Guilt and Regret: Overspending on credit cards often leads to feelings of guilt and regret. This emotional burden can make it harder to break out of the cycle of debt.

- Relationship Strain: Financial stress is one of the leading causes of relationship problems. Debt can lead to secrecy, mistrust, and conflict, putting a strain on personal relationships.

Balancing Credit Card Use with Mental Well-being

It’s crucial to balance your financial health with your mental well-being:

- Mindful Spending: By practicing mindful spending, you can avoid the emotional toll of debt and maintain a healthy relationship with your finances.

- Seek Help When Needed: If you’re feeling overwhelmed by debt, don’t hesitate to seek professional advice or counseling. There are financial counselors who specialize in helping people manage debt, and mental health professionals who can help you cope with the stress.

- Regular Check-ins: Incorporate mental health check-ins into your financial routine. Reflect on how your financial situation is affecting your mental well-being and make adjustments as needed.

Financial Well-Being and Mental Health Check-In Checklist

Use this checklist regularly to assess how your finances might be affecting your mental health. It’s a great way to reflect on your financial habits and how they impact your well-being.

| Category | Checklist Items |

|---|---|

| Stress Levels |

|

| Mood and Emotions |

|

| Coping Mechanisms |

|

| Impact on Relationships |

|

| Physical Health |

|

| Financial Control |

|

| Future Outlook |

|

| Support Systems |

|

Real-Life Examples: Learn from Others

Learn from those who’ve been there—real stories can guide your financial journey.

Success Stories

-

Emily's Strategy

Background: Emily, in her mid-20s, avoided debt by budgeting carefully.

Key Strategies:

- Budgeting: Used the 50/30/20 rule.

- Paying Off Balances: Cleared credit card balances monthly.

- Debt Prioritization: Focused on high-interest student loans.

- Emergency Fund: Built a 6-month cushion.

- Rewards Cards: Used strategically for everyday purchases.

Outcome: Emily paid off her loans early and maintained a healthy financial cushion.

Mark's Debt-Free Journey

Background: Mark, 29, resisted lifestyle inflation despite a good salary.

Key Strategies:

- Debt Repayment: Prioritized high-interest credit card debt.

- Lifestyle Control: Lived modestly despite income increases.

- Automated Savings: Set up automatic transfers for savings and debt.

- Smart Credit Use: Used cards for rewards, paying off balances monthly.

- Emergency Fund: Built an 8-month reserve.

Outcome: Mark became debt-free within two years and uses credit wisely.

Key Takeaways:

- Budgeting: Essential for avoiding debt.

- Prioritizing High-Interest Debt: Saves money in the long run.

- Emergency Fund: Provides financial security.

- Smart Credit Use: Maximizes benefits without incurring debt.

Take Control of Your Financial Future

Your financial future is in your hands—don’t let credit card debt take control.

By applying the strategies discussed in this guide, you can avoid the common debt traps that many young professionals face. Take action today by assessing your current credit card use, setting financial goals, and implementing the tips we’ve covered. Remember, credit cards are a tool, not a ticket to debt. Use them wisely, and you’ll build a strong financial foundation that will serve you well into the future.

Assess your current credit card situation—are you using your cards strategically? Set some financial goals for the next year and consider how your credit card habits align with these goals. Start implementing the tips discussed in this post to avoid falling into the credit card debt trap.