Buy Now, Pay Later: Is It a Smart Choice for Gen Z

Imagine buying your favorite gadget today without paying a cent upfront—sounds too good to be true? Welcome to the world of Buy Now, Pay Later (BNPL), where instant gratification meets modern finance. In today's fast-paced world, the ability to purchase items instantly and defer payment has revolutionized consumer behavior. BNPL services have become a popular payment method, particularly among younger generations. But while BNPL offers undeniable convenience, it's important to ask: Is it a smart financial choice for Gen Z? This post will delve into the pros and cons of BNPL for young consumers, exploring whether this financial tool is a friend or foe.

The Appeal of BNPL to Gen Z

Financial Flexibility and Accessibility: BNPL services provide Gen Z with the financial flexibility they crave. Unlike traditional credit systems, which often require extensive background checks and a solid credit history, BNPL allows for quick and easy access to credit. This is particularly appealing to younger consumers who may not have established credit yet. With quick approvals, minimal credit checks, and payments broken down into small, manageable chunks, BNPL allows Gen Z to purchase items without feeling the financial strain upfront. This aligns with their need for financial autonomy and control, enabling them to enjoy products immediately while managing their budget over time.

- BNPL services often offer promotional deals or interest-free periods, making high-ticket items more affordable for Gen Z.

- This payment method can help Gen Z build a positive credit profile when linked with credit bureaus, offering a pathway to establishing credit.

- The ability to manage payments over time supports their broader financial goals, such as saving for other important expenses without immediate compromise.

Avoidance of Traditional Credit: Having witnessed the pitfalls of traditional credit, such as high-interest rates and the risk of revolving debt, many Gen Z consumers are wary of credit cards. The 2008 financial crisis left a lasting impression, making them cautious about incurring large amounts of debt. BNPL offers an alternative that seems safer and more controlled, with lower or no interest rates as long as payments are made on time. This perceived safety net makes BNPL an attractive option for those looking to avoid the dangers associated with traditional credit.

- Many BNPL providers send reminders and offer flexible payment options, reducing the risk of late payments and associated fees.

- By using BNPL instead of credit cards, Gen Z can avoid the temptation of spending beyond their means, as BNPL often limits purchases to manageable amounts.

- The transparency of BNPL terms, with clear payment schedules and fees, contrasts with the often complex and opaque nature of credit card agreements, building trust among younger consumers.

Digital-Native Convenience: Gen Z, the first generation to grow up fully immersed in digital technology, values seamless and integrated experiences. BNPL fits perfectly into their online shopping habits, with services often embedded directly into e-commerce platforms. This integration allows for a smooth and effortless checkout process, enhancing the overall shopping experience. Furthermore, with mobile accessibility through apps, BNPL services cater to Gen Z’s mobile-first lifestyle, allowing them to manage their finances on the go.

- BNPL options are frequently integrated into social media shopping experiences, allowing Gen Z to purchase directly from platforms like Instagram or TikTok.

- These services often include user-friendly dashboards that allow Gen Z to track spending, upcoming payments, and budget insights in real-time.

- The ability to sync BNPL services with digital wallets and payment apps enhances the ease of use and aligns with Gen Z’s preference for streamlined financial management tools.

The Pros of Using BNPL

No-Interest Payments: One of the most significant advantages of BNPL is the ability to make interest-free purchases, provided payments are made according to the plan. This can be a major benefit for consumers who need to manage cash flow without incurring additional costs. For those who are disciplined in their payments, BNPL offers a cost-effective alternative to credit cards, which often carry high-interest rates if balances are not paid off immediately.

Simplicity and Predictability: BNPL services are designed with simplicity and transparency in mind. Fixed payment plans are straightforward, making it easier for consumers to budget and plan their finances. Unlike credit cards, which can accrue interest over time, BNPL agreements typically have clear terms with no hidden fees, as long as payments are made on time. This predictability can be particularly appealing to Gen Z, who may be new to managing finances and prefer clear, easy-to-understand financial commitments.

Easier Approval Process: For young consumers with little or no credit history, obtaining a traditional credit card can be challenging. BNPL services provide an alternative with a more accessible approval process. With minimal credit checks and a quick application process, BNPL allows consumers to access the products they want without the hurdles associated with traditional credit.

The Cons of Using BNPL

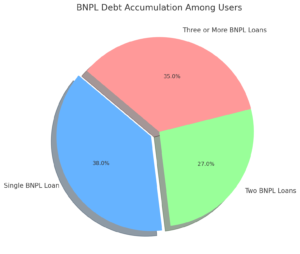

Risk of Debt Accumulation: While BNPL offers the convenience of deferred payments, it can also lead to overspending and debt accumulation. The ease of access to multiple BNPL loans across different platforms can create a complex web of payments that can be difficult to manage. This situation can quickly spiral into debt snowballing, where consumers find themselves overwhelmed by multiple payment obligations, especially if unexpected expenses arise.

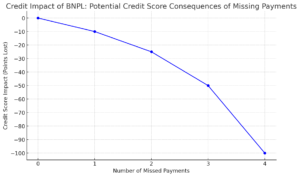

Lack of Consumer Protections: BNPL services operate in a relatively unregulated space compared to traditional credit products. This lack of regulation can leave consumers vulnerable to unforeseen fees and penalties. While BNPL services often advertise no interest, late payments can incur significant fees, and some services may charge interest on longer-term plans. Additionally, the absence of strong consumer protection laws means that users may not have the same recourse in case of disputes or issues with the service.

Potential for Overspending: The simplicity and convenience of BNPL can encourage impulsive buying behavior. The ability to defer payments can lead consumers to make purchases they might not have made if full payment were required upfront. This can disrupt personal budgets and lead to financial strain, particularly if consumers are not careful in managing their BNPL obligations.

Long-Term Financial Impact: While BNPL might seem like a short-term solution, it can have long-term implications for a consumer’s financial health. Missed payments, although often not reported to credit bureaus by BNPL providers, can still lead to debt being sent to collections, which can negatively impact credit scores. Additionally, the accumulation of multiple BNPL debts can cause significant financial stress, particularly for those already struggling to manage their finances.

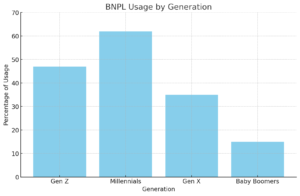

The Sentiment Among Gen Z

Cautious Optimism: Initially, Gen Z was quick to adopt BNPL services due to their accessibility and ease of use. However, as stories of debt accumulation and financial strain have become more common, there is a growing sense of caution among this demographic. While the convenience of BNPL is still appreciated, there is an increasing awareness of the risks involved.

Increasing Awareness of Risks: As BNPL usage grows, so does the understanding of its potential pitfalls. Financial literacy among young consumers is improving, with more emphasis on understanding the risks associated with deferred payments. This shift in perspective reflects a more cautious approach to BNPL, with an emphasis on responsible usage and awareness of the long-term financial implications.

Financial Education and Responsible Use

Importance of Financial Literacy: Financial education is crucial in helping young consumers navigate the complexities of BNPL services. Schools, financial institutions, and even BNPL providers themselves have a role to play in offering resources and educational materials that help young people understand the implications of using BNPL. Promoting awareness of responsible financial behavior is key to ensuring that BNPL is used as a tool for financial management rather than a gateway to debt.

Tips for Responsible Use: To avoid the pitfalls of BNPL, consumers should follow these guidelines:

- Set Spending Limits: Only use BNPL for purchases you can comfortably repay within the installment period.

- Track Payments: Keep a detailed record of all BNPL commitments to avoid missing payments.

- Avoid Multiple Plans: Limit yourself to one BNPL plan at a time to prevent debt accumulation.

- Understand the Terms: Always read and understand the terms and conditions of each BNPL service before using it.

- Consider Alternatives: Evaluate other payment options, like saving up for purchases or using a debit card, to avoid taking on unnecessary debt.

Alternatives to BNPL: For those who might struggle with BNPL, other options include:

- Traditional Savings: Saving up for purchases can eliminate the need for deferred payments altogether.

- Debit Card Payments: Using a debit card allows consumers to avoid debt entirely, as the funds are taken directly from their account.

- Low-Interest Credit Cards: For larger purchases, a low-interest credit card with better consumer protections might be a more suitable option.

Conclusion

BNPL offers a range of benefits, from financial flexibility to ease of access, but it also comes with significant risks, particularly for those who are not financially disciplined. While it can be a useful tool for managing short-term cash flow and avoiding credit card debt, the potential for overspending and debt accumulation cannot be ignored.

BNPL can be a smart financial tool if used wisely and with careful consideration of one's financial situation. However, it’s important for Gen Z, and all consumers, to approach it with caution. The allure of immediate gratification should not overshadow the responsibility that comes with managing deferred payments.

Before choosing to use BNPL services, consider your financial habits carefully. Assess whether you can truly afford the payments, and make sure you understand the terms and conditions. Share your experiences with BNPL in the comments—how has it affected your financial health?

Additional Resources

Links to Financial Literacy Resources:

- Consumer Financial Protection Bureau (CFPB): Resources on understanding credit and managing debt.

- National Endowment for Financial Education (NEFE): Offers educational resources on budgeting, saving, and responsible borrowing.

BNPL Service Comparisons:

- Affirm vs. Afterpay vs. Klarna: A breakdown of the key features, fees, and terms of the most popular BNPL services.

- Affirm: Flexible payment options with some interest-bearing plans.

- Afterpay: Interest-free payments with strict deadlines.

- Klarna: Offers both interest-free and interest-bearing options, depending on the plan.

This comprehensive exploration of BNPL and its impact on Gen Z aims to provide a balanced view of the benefits and risks associated with this modern financial tool. By understanding both sides, young consumers can make informed decisions that support their financial well-being.