Jeremiah

How Gen Z is Tackling Credit Card Debt: Strategies for a Debt-Free Future

Snowball Your Way to Financial Freedom: A Gen Z Guide to Crushing Debt

Yo, fellow broke millennials and Gen Z-ers! Feeling like you're stuck in a financial Squid Game, but without the cash prize at the end? Drowning in student loans, credit card bills, and that impulse purchase you made after binge-watching "Selling Sunset"? Don't sweat it, fam – we've all been there. Let's chat about how to dig yourself out of that money pit using the Debt Snowball Method. It's like KonMari-ing your finances, but instead of asking if things spark joy, we're asking if they're sucking your wallet dry. And who better to guide us through this than the OG of getting out of debt, Dave Ramsey?

Debt: The Ultimate Vibe Killer

Before we dive into Dave's wisdom, let's spill the tea about why debt is more toxic than your ex's Instagram stories:

- Student Loans: The gift that keeps on taking. You thought that degree would lead to a corner office, but here you are, eating instant ramen in your childhood bedroom.

- Credit Card Debt: Remember that time you said "YOLO" and booked a trip to Coachella? Yeah, your credit score remembers too.

- Personal Loans: Whether it's for your side hustle or that emergency wisdom teeth removal, these loans are as clingy as that person you drunk-texted once.

The impact? It's not just about the Benjamins, folks:

- Mental Health: Constant anxiety about checking your bank account is not the glow-up we're looking for.

- Life Goals: Want to move out, travel the world, or start that podcast about true crime and houseplants? Debt's standing in your way like a bouncer at the club you're too broke to get into anyway.

- Future You: While you're struggling to make minimum payments, your retirement savings are looking as empty as your DMs during a pandemic.

Enter the Debt Snowball Method: Dave Ramsey's Secret Sauce

Okay, so what's this Snowball thing that Dave Ramsey is always hyping? It's not a new TikTok dance challenge (although maybe it should be). The Debt Snowball Method is a genius way to pay off your debts that'll keep you more motivated than a double shot espresso.

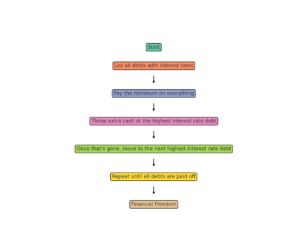

Here's the 411, straight from Dave's playbook:

- List all your debts from smallest to largest. (No cheating – your ego isn't a debt, even if it's huge.)

- Pay the minimum on everything (because adulting).

- Throw any extra cash at the smallest debt.

- Once that's gone, move to the next smallest. Rinse and repeat.

It's like playing Candy Crush, but instead of lining up colorful candies, you're crushing debts. Sweet!

Snowball vs. Avalanche: The Ultimate Debt-Slaying Showdown

Now, you might have heard of another method – the Debt Avalanche, championed by Suze Orman (you know, that financial guru your mom follows on Facebook). Let's break down the difference:

- Debt Avalanche (Suze's Jam):

- Pay off highest interest rates first, regardless of balance.

- Pros: Saves you more money in the long run, like choosing the salad over fries (but who really does that?).

- Cons: Might take longer to see visible progress, especially if your highest-interest debt is also your largest.

- Debt Snowball (Dave's Choice):

- Pay off smallest debts first, regardless of interest rate.

- Pros: Quick wins that feel good, like getting a match on a dating app (that actually messages you back).

- Cons: You might pay more in interest over time, but hey, motivation is priceless.

Dave Ramsey champions the Snowball method because it's psychologically superior. It's like choosing between a flashy TikTok dance (Snowball) and a complicated yoga routine (Avalanche) – the dance might not be as intense, but you're more likely to stick with it and show it off to your friends.

Snowball Method: A Step-by-Step Guide for the Financially Challenged

Let's break down Dave's strategy:

- Get Organized: List your debts like you're planning the ultimate music festival lineup. Use a spreadsheet, an app, or go old school with pen and paper (just don't use the back of an overdue bill).

- Minimum Payments are Your New BFF: Pay the minimum on everything. It's like maintaining streaks on Snapchat – gotta keep that momentum.

- Find Your Starter Pokémon: Identify the smallest debt. That's your first target.

- Channel Your Inner Gamer: Any extra cash goes to defeating that small debt. Think of it as power-ups in your debt-busting game.

- Rinse and Repeat: Once you've conquered one debt, move on to the next smallest. It's like leveling up, but for your bank account.

Pro Tips from the Money Maestro: Dave Ramsey

Dave Ramsey is like the cool uncle of finance, if your cool uncle was really into budgeting and yelling "Live like no one else, so later you can live like no one else!" Here's what he'd tell you over a cup of homemade coffee (because Starbucks is for people not serious about their debt):

- Stay Gazelle Intense: Treat your debt repayment plan like you're a gazelle running from a cheetah. The cheetah is debt, and it wants to eat your future.

- Cash is King: Use the envelope system for budgeting. It's like meal prepping, but for your money.

- No New Debt: Credit cards are like that ex you keep going back to. Cut them up, block their number, and move on.

- Side Hustle Hard: Get a part-time job or start a side gig. Your free time is now making-money time.

Real People, Real Success: Dave-Approved Stories

Let's look at some folks who crushed it with the Snowball Method, making Dave proud:

Emma's Epic Win: Demolished $10K in credit card debt in 18 months. How? Cut out unnecessary subscriptions (goodbye, 7th streaming service) and started a side hustle selling vintage finds on Depop.

Liam's Loan Takedown: Wiped out student loans in three years by living on rice and beans (literally) and turning their dog-walking gig into a full-fledged pet-sitting empire on Rover.

Gamify Your Debt Repayment: Dave Ramsey Meets Fortnite

Make paying off debt as addictive as scrolling through TikTok:

- Create Milestones: Set small goals and reward yourself (in budget-friendly ways) when you hit them. Dave would approve of a victory dance in your living room.

- Visualize Progress: Use debt payoff apps or create a visual chart. Watching that debt shrink is more satisfying than popping bubble wrap.

- Challenge Friends: Start a debt payoff challenge with friends. First one to pay off a certain amount gets treated to a home-cooked meal (because restaurants are for the weak, according to Dave).

Staying Motivated When the FOMO Hits

Let's be real – paying off debt while your friends are living it up on Instagram can be tougher than explaining NFTs to your grandma. Here's how to keep your eyes on the prize, Dave Ramsey style:

- Reframe Your Mindset: Think of debt payoff as investing in your future self. Future you will be thanking present you for those sacrifices (and probably for not buying those NFTs).

- Find Free Fun: Get creative with free activities. Nature hikes, free museum days, or hosting potluck game nights can be just as gram-worthy as that overpriced brunch.

- Celebrate Small Wins: Paid off $100? That's worth a celebration! Do a happy dance, post a humble brag, or treat yourself to a fancy coffee (but just one, Dave is watching with disapproval!).

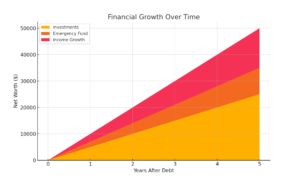

Beyond Debt: Building Your Financial Empire

Once you've slayed your debt dragon, it's time to level up your money game. Here's what Dave Ramsey would want you to do next:

- Emergency Fund: Start building that safety net. Aim for 3-6 months of expenses, or enough to survive the zombie apocalypse (whichever comes first).

- Invest in Yourself: Consider low-cost ways to boost your skills. Online courses, workshops, or certifications can increase your earning potential faster than you can say "multi-level marketing scheme" (which, by the way, Dave would tell you to avoid like the plague).

- Start Investing: Even small amounts in index funds can grow over time. It's like planting seeds for your future money tree, but less work than actual gardening.

- Give Back: Once you're debt-free and building wealth, remember to be generous. It's good karma, and it'll make you feel richer than any designer label could.

Drop the Mic: Final Thoughts

Crushing debt isn't just about the numbers – it's about taking control of your life and building the future you want. The Debt Snowball Method, championed by Dave Ramsey, is your secret weapon in this financial boss battle.

Remember, every payment is a step towards freedom. It might not be as instantly gratifying as getting likes on your latest post, but trust us, the long-term payoff is way better than any fleeting social media dopamine hit.

So, are you ready to start your debt snowball and roll your way to financial freedom? Drop a comment, share your goals, or hit us up with your best debt-crushing memes. Let's turn that financial frown upside down and make Dave Ramsey proud!

#DebtFreeJourney #SnowballMethod #GenZMoney #DaveRamseyWouldBeProud

Top 5 Credit Cards for Gen Z: Adulting Without the Tears

Hey there, fellow broke Gen Z-ers! Are you ready to dip your toes into the wild world of adulting? Buckle up, because we're about to talk about something scarier than your student loan balance: credit cards. But don't worry, we've got your back like that one friend who always holds your hair during a rough night out.

Why Building Credit Early Matters (aka Your Future Self Will Thank You)

Before we dive into the juicy details of credit cards, let's talk about why you should care about building credit in the first place. Think of your credit score as your financial Instagram follower count – the higher it is, the more doors open for you.

Here's the tea on why good credit is like having a golden ticket to Willy Wonka's Chocolate Factory of adulting:

- Lower interest rates (because who wants to pay more for stuff?)

- Better loan terms (hello, future house!)

- Landlords who actually want to rent to you (bye-bye, mom's basement!)

Now, let's meet the fab five credit cards that'll help you build your credit empire faster than you can say "avocado toast."

The Fantastic Five: Credit Cards That Won't Make You Cry

- Discover it® Student Cash Back: The Beyoncé of student credit cards

- Capital One Journey® Student Rewards Credit Card: For when you're on a journey to financial adulthood

- Deserve® EDU Mastercard for Students: Because you deserve nice things, right?

- Discover it® Student Chrome: Shiny like chrome, but won't rust your credit

- Capital One SavorOne Student Cash Rewards Credit Card: For those who like to savor life (and cash back)

Let's Get Down to Business: The Nitty-Gritty Details

Show Me the Money: Rewards Program Showdown

Cash Back Rewards Credit Cards Comparison

| Credit Card | Rewards Details | Category |

|---|---|---|

| Deserve EDU Mastercard | 1% on all purchases | Good |

| Capital One Journey Student | 1%, 1.25% for on-time payments | Good |

| Discover it Student Chrome | 2% at Gas & Restaurants, 1% on others | Better |

| Discover it Student Cash Back | 5% on rotating categories, 1% on others | Best |

| Capital One SavorOne Student | 3% on dining, entertainment, streaming, groceries, 1% on others | Best |

Annual Fees: The Price of Admission (Spoiler: It's Free!)

Good news, fam! All five of these cards have a $0 annual fee. That's right, they're as free as the advice your parents give you (but way more useful).

APR Rates: The Fine Print That'll Make Your Eyes Cross

Warning: This section contains numbers. But don't worry, we'll get through this together.

But Wait, There's More! Unique Features That'll Make You Go "Ooh"

| Card | Unique Features | Cool Factor |

|---|---|---|

| Discover it® Student Cash Back | Free FICO score monitoring, First-year cash back match | 🌟🌟🌟🌟🌟 |

| Capital One Journey® Student | No foreign transaction fees, Credit line reviews | 🌟🌟🌟🌟 |

| Deserve® EDU Mastercard | No security deposit, Cell phone protection, Amazon Prime Student subscription reimbursement | 🌟🌟🌟🌟🌟 |

| Discover it® Student Chrome | Free FICO score monitoring, First-year cash back match | 🌟🌟🌟🌟 |

| Capital One SavorOne Student | No foreign transaction fees | 🌟🌟🌟 |

The Final Showdown: Rating Our Fab Five

Alright, it's time for the moment you've all been waiting for – the ultimate showdown of our credit card contenders. We're going to break it down for you, Buzzfeed-style, so you know exactly which plastic fantastic is your perfect match. Let's get ready to rumble!

Overall Ratings: From "Meh" to "Take My Money!"

- Capital One Journey Student

- Rating: 🏆🏆🏆

- Discover it Student Chrome

- Rating: 🏆🏆🏆

- Deserve EDU Mastercard

- Rating: 🏆🏆🏆🏆

- Capital One SavorOne Student

- Rating: 🏆🏆🏆🏆

- Discover it Student Cash Back

- Rating: 🏆🏆🏆🏆🏆

- Best Overall

The "Best For" Breakdown: Finding Your Perfect Match

- Discover it® Student Cash Back:

- Best For: The overachiever who wants it all

- Why: With its rotating 5% cash back categories and first-year cash back match, this card is like the valedictorian of credit cards. It's perfect for those who love to maximize rewards and don't mind keeping track of categories.

- Capital One Journey® Student Rewards Credit Card:

- Best For: The world traveler on a ramen budget

- Why: No foreign transaction fees make this the ideal companion for your study abroad Instagram stories. Plus, the extra 0.25% cash back for on-time payments is perfect for those who need a little nudge to adult responsibly.

- Deserve® EDU Mastercard for Students:

- Best For: The "I can't even" crowd who need simplicity

- Why: No credit history? No problem! This card is like the non-judgmental friend who accepts you as you are. With no security deposit required and that sweet Amazon Prime Student subscription reimbursement, it's perfect for those just starting out.

- Discover it® Student Chrome:

- Best For: The social butterfly who's always grabbing coffee or filling up the gas tank

- Why: With 2% cash back at gas stations and restaurants, this card is made for those who are always on the go. It's like having a fuel-efficient car, but for your wallet.

- Capital One SavorOne Student Cash Rewards Credit Card:

- Best For: The foodie who's always trying the hottest new restaurants

- Why: 3% cash back on dining, entertainment, popular streaming services, and grocery stores? It's like this card was made for your Instagram food pics and Netflix binges.

The TL;DR Version: Quick Picks for the Impatient Gen Z-er

- Best Overall: Discover it® Student Cash Back (for those who want to squeeze every drop of value)

- Best for Simplicity: Deserve® EDU Mastercard (for when "adulting" feels like too much)

- Best for Foodies: Capital One SavorOne Student (for when your love language is food)

- Best for Travelers: Capital One Journey® Student (for those with wanderlust but a Walmart budget)

- Best for Commuters: Discover it® Student Chrome (for when your car is basically your second home

Real Talk: What the Cool Kids Are Saying

Don't just take our word for it. Here's what your fellow Gen Z-ers are saying about these cards:

"Thanks to my Discover it® Student Cash Back card, I finally have a credit score higher than my GPA!" - Alex, 21

"The Capital One Journey® card helped me budget my spring break trip without calling the Bank of Mom & Dad." - Jordan, 20

"I got the Deserve® EDU Mastercard, and now I can Netflix and chill without borrowing my ex's password." - Taylor, 22

Pro Tips: How to Adult Like a Boss

- Pay your balance in full: Treat your credit card bill like that one clingy friend – deal with it quickly and completely.

- Set up autopay: Because remembering due dates is so last century.

- Keep your utilization low: Use your credit card like you use your phone data – sparingly and strategically.

- Maximize those rewards: Get cash back on things you'd buy anyway, like coffee and more coffee.

The Grand Finale: Choose Your Fighter

There you have it, folks – the top 5 credit cards that'll help you adult without crying into your ramen every night. Whether you're team Discover, Capital One, or Deserve, remember that building credit is a marathon, not a sprint (unlike your last-minute exam cramming sessions).

So, which card will be your financial BFF? Are you ready to swipe right on your credit future? Drop a comment and let us know which card you're eyeing, or share your own credit-building war stories. Let's get this bread (and credit score)! 💪💳✨

#CreditCardGoals #GenZFinance #AdultingLikeABoss

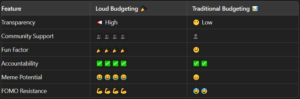

Loud Budgeting: The Gen Z Financial Revolution (Tori Dunlap and Ramit Sethi Approved)

Hey there, fellow broke millennials and Gen Z-ers! Feeling like your bank account is emptier than your DMs? Don't worry, we've all been there. Let's talk about the hottest trend since TikTok dances: Loud Budgeting. It's like shouting your financial goals from the rooftops, but instead of your neighbors calling the cops, they'll be sliding into your DMs for money advice.

What's the Deal with Loud Budgeting?

Before we dive into the juicy details, let's break down why your current financial situation probably sucks more than that "let's grab coffee sometime" text from your ex:

- Student Loans: The gift that keeps on taking. You thought that degree would lead to a corner office, but here you are, working from the corner of your bedroom.

- Credit Card Debt: Remember that time you said "YOLO" and splurged on a full-price Coachella ticket? Yeah, your credit score remembers too.

- Impulse Purchases: Those late-night online shopping sprees seemed like a good idea at the time, right?

The impact? It's not just about the money, fam:

- Mental Health: Constant anxiety about checking your bank account is not the vibe.

- Life Goals: Want to move out, travel the world, or start that podcast empire? Your empty wallet is standing in your way like a bouncer at an exclusive club.

- Future You: While you're struggling to make minimum payments, your retirement savings are looking as empty as your fridge after a weekend binge.

Enter Loud Budgeting: Your Financial Glow-Up Awaits

Okay, so what's this Loud Budgeting thing that Tori Dunlap and Ramit Sethi are raving about? It's not a new budgeting app (although maybe it should be). Loud Budgeting is all about being open and proud about your financial habits and boundaries. It's like Marie Kondo-ing your finances, but instead of asking if things spark joy, we're asking if they're worth the #MoneySelfie.

Here's the tea, straight from the financial influencer gospel:

- Get real with yourself about your money situation.

- Set some goals that aren't just "become a billionaire overnight."

- Create a budget that doesn't make you want to cry.

- Tell the world about it like you're announcing your relationship status change.

It's like playing a video game, but instead of defeating bosses, you're crushing financial goals. Level up!

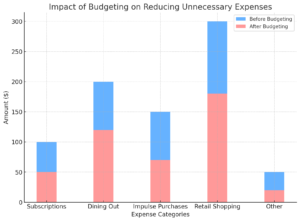

Loud Budgeting: A Step-by-Step Guide for the Financially Challenged

Let's break down this financial flex:

- Get Organized: List your income, debts, and expenses like you're planning the guest list for the most exclusive party ever.

- Set Some Goals: Want to save for a trip? Pay off that credit card? Buy a house before you're 80? Write it down and make it Instagram official.

- Budget Like a Boss: Create a spending plan that doesn't make you want to ugly cry. Remember, it's about progress, not perfection.

- Shout It Out: Share your goals on social media. It's like meal prep posts, but for your wallet.

- Find Your Money Squad: Join online communities or start a finance club with your friends. It's like a book club, but instead of pretending to read, you're pretending to understand crypto.

Pro Tips from the Money Mavens: Tori Dunlap and Ramit Sethi

Tori Dunlap and Ramit Sethi are like the cool older siblings of finance. Here's what they'd tell you over oat milk lattes:

- Consistency is Key: Treat your budget like your skincare routine – do it religiously.

- Knowledge is Power: Understand your finances like you understand memes. Know those interest rates!

- Track That Progress: Use apps to visualize your savings growing. It's as satisfying as watching your TikTok followers increase.

- Community is Everything: Share your wins and setbacks. Your followers are there for the journey, not just the highlight reel.

Real People, Real Success: #LoudBudgeting Stories

Let's look at some folks who crushed it with Loud Budgeting, making Tori and Ramit proud:

Alex's Glow-Up: Saved $10K in a year by meal prepping and starting a side hustle selling vintage finds on Depop. Documented the whole journey on Instagram.

Jordan's Debt-Free Dream: Paid off student loans in three years by living with roommates and turning their dog-walking gig into a full-fledged pet-sitting empire on Rover. Shared weekly updates on TikTok.

Gamify Your Finances: Tori Dunlap Meets Fortnite

Make budgeting as addictive as scrolling through TikTok:

- Create Milestones: Set small goals and reward yourself (in budget-friendly ways) when you hit them.

- Visualize Progress: Use finance apps or create a visual chart. Watching that savings grow is oddly satisfying.

- Challenge Friends: Start a savings challenge with friends. First one to hit their goal gets treated to coffee (or a homemade Dalgona coffee, because we're saving money here).

Staying Motivated When the FOMO Hits

Let's be real – saving money while your friends are living it up on Instagram can be tough. Here's how to keep your eyes on the prize, Ramit Sethi style:

- Reframe Your Mindset: Think of budgeting as investing in your future self. Future you will be thanking present you for those sacrifices.

- Find Free Fun: Get creative with free activities. Nature hikes, free museum days, or hosting potluck game nights can be just as gram-worthy.

- Celebrate Small Wins: Saved $100? That's worth a celebration! Do a happy dance, post a humble brag, or treat yourself to a fancy coffee (but just one, Tori is watching!).

Beyond Budgeting: Building Your Financial Empire

Once you've mastered the art of Loud Budgeting, it's time to level up your money game. Here's what Tori and Ramit would want you to do next:

- Emergency Fund: Start building that safety net. Aim for 3-6 months of expenses.

- Invest in Yourself: Consider low-cost ways to boost your skills. Online courses, workshops, or certifications can increase your earning potential.

- Start Investing: Even small amounts in index funds or robo-advisors can grow over time. It's like planting seeds for your future money tree.

- Side Hustle: Keep that extra income flowing. Whether it's freelancing, selling crafts, or becoming a part-time influencer, diversify that income stream.

Drop the Mic: Final Thoughts

Loud Budgeting isn't just about flexing your savings account (although that's a nice perk). It's about taking control of your financial narrative and building the future you want. It's like being the main character in your own money movie, and honey, you're ready for your close-up.

Remember, every dollar saved is a step towards freedom. It might not be as instantly gratifying as getting likes on your latest post, but trust us, the long-term payoff is way better than any fleeting social media dopamine hit.

So, are you ready to get loud about your budget? Drop a comment, share your goals, or hit us up with your best money-saving memes. Let's turn those financial frowns upside down!

#LoudBudgeting #FinancialFreedom #GenZMoney #ToriDunlapApproved #RamitSethiSays

Avalanche Your Way Out of Debt: A Guide to Financial Freedom (Suze Orman Style)

Hey there, fellow broke millennials and Gen Z-ers! Feeling like you're drowning in a sea of student loans, credit card bills, and that impulse purchase you made after your third White Claw? Don't worry, we've all been there. Let's talk about how to dig yourself out of that financial hole using the Debt Avalanche Method – it's like Marie Kondo-ing your finances, but instead of asking if things spark joy, we're asking if they're draining your bank account. And who better to guide us through this than the queen of personal finance herself, Suze Orman?

Ready to crush your debt?

Click here to get your free interactive PDF and start your journey to financial freedom!

Debt: The Ultimate Mood Killer

Before we dive into Suze's wisdom, let's real talk about why debt sucks more than a phone with 1% battery:

- Student Loans: The gift that keeps on taking. You thought that degree would lead to a six-figure job, but here you are, eating ramen in your parent's basement.

- Credit Card Debt: Remember that time you said "YOLO" and booked a trip to Coachella? Yeah, your credit card remembers too.

- Personal Loans: Whether it's for your side hustle or that emergency root canal, these loans can be as persistent as your ex sliding into your DMs.

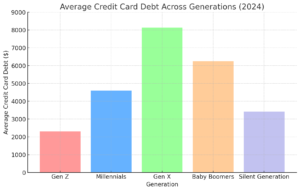

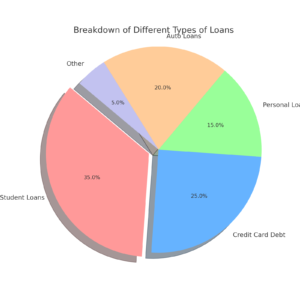

The Struggle is Real: Breakdown of Average Gen Z Debt

The impact? It's not just about the money:

- Mental Health: Constant anxiety about checking your bank account is not the vibe.

- Life Goals: Want to move out, travel the world, or start that podcast empire? Debt's standing in your way like a bouncer at an exclusive club.

- Future You: While you're struggling to make minimum payments, your retirement savings are looking as empty as your Instagram feed during a social media cleanse.

Enter the Debt Avalanche Method: Suze Orman's Secret Weapon

Okay, so what's this Avalanche thing that Suze Orman swears by? It's not a new TikTok dance challenge (although maybe it should be). The Debt Avalanche Method is a smart way to pay off your debts that'll save you money in the long run.

Here's the tea, straight from Suze:

- List all your debts with their interest rates.

- Pay the minimum on everything (because adulting).

- Throw any extra cash at the debt with the highest interest rate.

- Once that's gone, move to the next highest. Rinse and repeat.

It's like playing a video game, but instead of defeating bosses, you're crushing debts. Level up!

Suze Orman's Debt Avalanche Method: Your Roadmap to Financial Freedom

Ready to crush your debt?

Click here to get your free interactive PDF and start your journey to financial freedom!

Avalanche vs. Snowball: The Ultimate Debt-Slaying Showdown

Now, you might have heard of another method – the Debt Snowball, popularized by Dave Ramsey (you know, that guy your parents listen to on the radio). Let's break down the difference:

- Debt Snowball (Dave Ramsey's Jam):

- Pay off smallest debts first, regardless of interest rate.

- Pros: Quick wins that feel good, like getting those small achievements in a game.

- Cons: You might pay more in interest over time.

- Debt Avalanche (Suze Orman's Choice):

- Tackle highest interest rates first, regardless of balance.

- Pros: Saves you more money in the long run, like playing chess while everyone else is playing checkers.

- Cons: Might take longer to see visible progress, especially if your highest-interest debt is also your largest.

Avalanche vs Snowball: The Numbers Don't Lie (But Your Heart Might)

Suze Orman champions the Avalanche method because it's mathematically superior. It's like choosing between a flashy sports car (Snowball) and a reliable hybrid (Avalanche) – the hybrid might not turn heads immediately, but it'll get you further in the long run.

Avalanche Method: A Step-by-Step Guide for the Financially Challenged

Let's break down Suze's strategy:

- Get Organized: List your debts like you're planning a chaotic group chat. Use a spreadsheet, an app, or go old school with pen and paper.

- Minimum Payments are Your New BFF: Pay the minimum on everything. It's like maintaining streaks on Snapchat – gotta keep that momentum.

- Find Your Big Bad: Identify the debt with the highest interest rate. That's your final boss.

- Channel Your Inner Gamer: Any extra cash goes to defeating that high-interest debt. Think of it as power-ups in your debt-busting game.

- Rinse and Repeat: Once you've conquered one debt, move on to the next highest interest rate. It's like prestige mode, but for your finances.

Pro Tips from the Money Queen

Suze Orman is like the cool aunt of finance. Here's what she'd tell you over brunch:

- Stay Consistent: Treat your debt repayment plan like your skincare routine – do it religiously.

- Knowledge is Power: Understand your debts like you understand memes. Know those interest rates!

- Track That Progress: Use apps to visualize your debt shrinking. It's as satisfying as watching your follower count grow.

- Squad Goals: Share your financial journey with friends. Accountability is key, and maybe you'll inspire a TikTok challenge.

Real People, Real Success

Let's look at some folks who crushed it with the Avalanche Method, making Suze proud:

Alex's Glow-Up: Demolished $15K in credit card debt in two years. How? Cut out unnecessary subscriptions (goodbye, 7th streaming service) and started a side hustle selling vintage finds on Depop.

Jordan's Debt-Free Dream: Wiped out student loans in four years by prioritizing high-interest debts. The secret sauce? Living with roommates to save on rent and turning their dog-walking gig into a full-fledged pet-sitting empire on Rover.

Real Debt Payoff Journeys: It's Not Always Pretty, But It Works!

Ready to crush your debt?

Click here to get your free interactive PDF and start your journey to financial freedom!

Gamify Your Debt Repayment: Avalanche Method Meets Fortnite

Make paying off debt as addictive as scrolling through TikTok:

- Create Milestones: Set small goals and reward yourself (in budget-friendly ways) when you hit them. Suze would approve!

- Visualize Progress: Use debt payoff apps or create a visual chart. Watching that debt shrink is oddly satisfying.

- Challenge Friends: Start a debt payoff challenge with friends. First one to pay off a certain amount gets treated to coffee (or a homemade Dalgona coffee, because we're saving money here).

Staying Motivated When the FOMO Hits

Let's be real – paying off debt while your friends are living it up on Instagram can be tough. Here's how to keep your eyes on the prize, Suze Orman style:

- Reframe Your Mindset: Think of debt payoff as investing in your future self. Suze always says, "Future you will be thanking present you for those sacrifices."

- Find Free Fun: Get creative with free activities. Nature hikes, free museum days, or hosting potluck game nights can be just as gram-worthy.

- Celebrate Small Wins: Paid off $100? That's worth a celebration! Do a happy dance, post a humble brag, or treat yourself to a fancy coffee (but just one, Suze is watching!).

Beyond Debt: Building Your Financial Empire

Once you've slayed your debt dragon, it's time to level up your money game. Here's what Suze Orman would want you to do next:

- Emergency Fund: Start building that safety net. Aim for 3-6 months of expenses.

- Invest in Yourself: Consider low-cost ways to boost your skills. Online courses, workshops, or certifications can increase your earning potential.

- Start Investing: Even small amounts in index funds or robo-advisors can grow over time. It's like planting seeds for your future money tree.

- Side Hustle: Keep that extra income flowing. Whether it's freelancing, selling crafts, or becoming a part-time influencer, diversify that income stream.

Your Financial Glow-Up: Watch Your Money Grow Post-Debt

Ready to crush your debt?

Click here to get your free interactive PDF and start your journey to financial freedom!

Drop the Mic: Final Thoughts

Crushing debt isn't just about the numbers – it's about taking control of your life and building the future you want. The Debt Avalanche Method, championed by Suze Orman, is your secret weapon in this financial boss battle.

Remember, every payment is a step towards freedom. It might not be as instantly gratifying as getting likes on your latest post, but trust us, the long-term payoff is way better than any fleeting social media dopamine hit.

So, are you Team Avalanche (Suze Orman) or Team Snowball (Dave Ramsey)? Drop a comment, share your goals, or hit us up with your best debt-crushing memes. Let's turn that financial frown upside down!

#DebtFreeJourney #FinancialFreedom #GenZMoney

Ready to crush your debt?

Click here to get your free interactive PDF and start your journey to financial freedom!

Conquering Debt: Suze Orman’s Debt Avalanche Method

Debt can be an overwhelming mountain to climb, especially when it feels like you're barely making a dent. For those looking to pay off debt efficiently, the Debt Avalanche Method offers a financially sound strategy. Championing this approach is Suze Orman, a renowned financial advisor known for her practical and empowering financial advice. In this post, we'll explore Suze Orman's philosophy and how the Debt Avalanche Method can help you achieve financial freedom.

Understanding Debt and Its Impact

Debt comes in many forms and can significantly impact various aspects of life. Some of the most common types of debt include:

- Student Loans: These can be a huge burden right out of college, affecting your ability to save and invest early.

- Credit Card Debt: Often results from high-interest rates and can quickly spiral out of control if not managed properly.

- Personal Loans: Taken out for big purchases or emergencies, these can add up and lead to financial strain.

The impact of debt extends beyond just financial stress. It can affect:

- Mental Health: Constant worry about debt can lead to anxiety and depression.

- Lifestyle Choices: High debt can limit your ability to make significant life choices like buying a home, traveling, or starting a family.

- Future Financial Goals: The more debt you have, the harder it is to save for retirement or invest in opportunities that could grow your wealth.

Understanding the full impact of debt underscores the importance of taking control of your financial situation early and effectively.

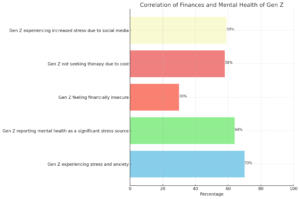

The Impact of Financial Stress on Mental Health Among Generation Z

This graph illustrates the correlation between financial factors and mental health among Generation Z. It shows the percentages of Gen Z individuals affected by various stressors:

- 70% of Gen Z experience stress and anxiety, reflecting overall mental health challenges.

- 64% report that their mental health has been a significant source of stress in the past year.

- 30% feel financially insecure, highlighting the impact of financial stress.

- 58% do not seek therapy due to the high cost, indicating financial barriers to mental health care.

- 59% experience increased stress and anxiety due to social media, which often exacerbates financial concerns.

This data underscores the significant interplay between financial stress and mental health issues within this generation.

What is the Debt Avalanche Method?

The Debt Avalanche Method is a debt repayment strategy that prioritizes paying off debts with the highest interest rates first. This approach aims to minimize the amount of interest paid over time, making it a more financially efficient method compared to other strategies like the Debt Snowball Method, which focuses on paying off the smallest debts first for quick wins.

Contrast with the Debt Snowball Method:

- Debt Snowball: Prioritizes smallest debt balances for quick psychological wins.

- Debt Avalanche: Prioritizes highest interest rates to minimize total interest paid and accelerate debt repayment.

Steps to Implement the Debt Avalanche Method

- List Your Debts: Create a detailed list of all your debts, including balances and interest rates. Tools like Excel, Google Sheets, or budgeting apps can be helpful.

- Make Minimum Payments: Ensure you make minimum payments on all your debts to stay current and avoid penalties.

- Focus on the Highest Interest Debt: Allocate any extra funds towards paying off the debt with the highest interest rate first. This strategy reduces the total interest paid over time.

- Repeat the Process: Once the highest interest debt is paid off, move on to the next highest interest debt with the freed-up funds. Continue this process until all debts are paid off.

Benefits of the Debt Avalanche Method

- Financial Savings: By focusing on high-interest debts, you minimize the total interest paid, saving money in the long run.

- Faster Debt Repayment: Reducing interest payments accelerates the overall debt repayment process.

- Long-Term Financial Health: This method promotes long-term financial stability and efficiency, setting you up for a debt-free future.

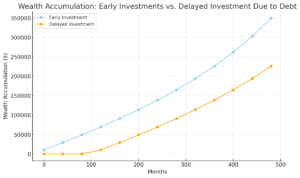

Financial Savings Over Time: Debt Avalanche Method vs. No Method

This line graph illustrates the financial savings achieved over a period of 24 months using the Debt Avalanche Method compared to having no structured debt repayment method.

Key Points:

- Debt Avalanche Method: The line marked with circles shows the total savings when following the Debt Avalanche Method. This method prioritizes paying off debts with the highest interest rates first, resulting in significant savings on interest over time.

- No Structured Method: The line marked with crosses represents the savings when no specific debt repayment strategy is used. The savings grow at a slower pace due to higher interest payments on outstanding debts.

By following the Debt Avalanche Method, individuals can save more money over time compared to not using a structured debt repayment plan. This visual comparison underscores the financial efficiency and benefits of the Debt Avalanche Method in reducing overall debt more quickly and saving on interest costs.

Tips from Suze Orman

Suze Orman offers a wealth of advice for those looking to manage their debt efficiently. Here are some of her key tips:

- Stay Disciplined: Consistency is crucial. Stick to your debt repayment plan and avoid taking on new debt.

- Educate Yourself: Knowledge is power. Understand your debts, interest rates, and financial options.

- Track Your Progress: Regularly review your debts and progress. Use apps and tools to stay organized and motivated.

- Seek Support: Share your goals with friends, family, or online communities for encouragement and accountability.

Real-Life Success Stories

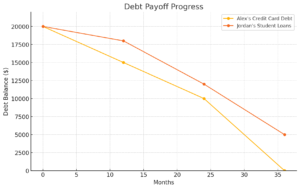

Here are a couple of inspiring stories from individuals who have successfully used the Debt Avalanche Method:

- Alex: Paid off $15,000 in credit card debt in two years by focusing on high-interest debts. By cutting unnecessary expenses and taking on freelance work, Alex accelerated his debt repayment.

- Jordan: Eliminated student loans in four years by prioritizing the highest interest rates first. Jordan's disciplined approach and extra payments from a side hustle significantly reduced overall interest costs.

Lessons Learned:

- Focusing on high-interest debts saves money.

- Extra income sources can accelerate debt repayment.

- Staying disciplined and motivated is key to success.

Comparing Debt Avalanche to Debt Snowball

While both methods aim to help you get out of debt, they do so in different ways:

- Debt Avalanche Method (Suze Orman):

- Focuses on paying off debts with the highest interest rates first.

- Minimizes total interest paid over time.

- Financially efficient but may take longer to see psychological wins.

- Debt Snowball Method (Dave Ramsey):

- Focuses on paying off the smallest debts first.

- Provides quick psychological wins to maintain motivation.

- May result in paying more interest over time compared to the Debt Avalanche Method.

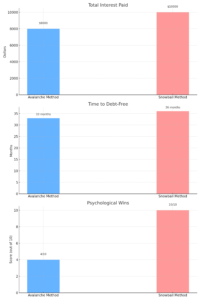

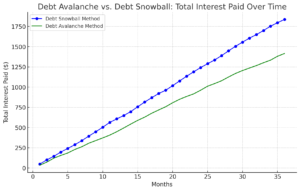

Debt Avalanche vs. Debt Snowball: Total Interest Paid Over Time

This graph compares the Debt Avalanche Method and the Debt Snowball Method in terms of total interest paid over a period of 36 months. The blue line represents the Debt Snowball Method, which prioritizes paying off the smallest debts first. The green line represents the Debt Avalanche Method, which focuses on paying off debts with the highest interest rates first.

Key Takeaways:

- Debt Snowball Method: While this method offers quick psychological wins by eliminating smaller debts first, it generally results in higher total interest paid over time.

- Debt Avalanche Method: This method minimizes the total interest paid by focusing on high-interest debts first, leading to greater long-term financial savings.

By following the Debt Avalanche Method, you can reduce the amount of interest paid and accelerate your journey to becoming debt-free.

Take Control of Your Financial Future

The Debt Avalanche Method, championed by Suze Orman, offers a powerful strategy for managing debt efficiently. By prioritizing high-interest debts, you can save money on interest and pay off your debts faster. Consider implementing this method to take control of your financial future.

Take the first step today by listing all your debts and making a plan to tackle the highest interest one. Share your progress, leave comments with questions or success stories, and follow our blog for more financial tips and advice.

How you Can Use Dave Ramsey’s Debt Snowball Method to Crush Debt

Are you feeling overwhelmed by debt? Whether it's student loans, credit card bills, or personal loans, managing debt can be a daunting task. But don't worry, there's a strategy that can help you take control of your finances and achieve financial freedom. It's called the Debt Snowball Method, popularized by financial expert Dave Ramsey. In this post, we'll break down what it is, why it's effective, and how you can use it to crush your debt.

Understanding Debt and Its Impact

Debt comes in many forms, and for many, the most common types include:

- Student Loans: These can be a huge burden right out of college.

- Credit Card Debt: Easy to accumulate but hard to pay off.

- Personal Loans: Often taken out for big purchases or emergencies.

Debt can have a significant impact on your mental health, lifestyle, and future goals. It's essential to take control of your financial situation early to avoid long-term stress and limited opportunities.

What is the Debt Snowball Method?

The Debt Snowball Method, championed by Dave Ramsey, is a debt repayment strategy where you focus on paying off your smallest debts first to build momentum. Unlike other methods that prioritize high-interest debts, this approach leverages psychological wins to keep you motivated.

Why is it effective?

- Psychological Boost: Quick wins keep you motivated.

- Momentum: Each debt paid off frees up more money to tackle the next one.

- Behavioral Focus: Encourages disciplined spending and repayment habits.

Steps to Implement the Debt Snowball Method

- List Your Debts:

- Create a comprehensive list of all your debts from smallest to largest balance.

- Use tools like Excel, Google Sheets, or budgeting apps to keep track.

- Make Minimum Payments:

- Ensure you stay current on all your debts by making minimum payments.

- Budgeting apps like Mint or YNAB can help manage this.

- Focus on the Smallest Debt:

- Allocate any extra money towards paying off the smallest debt first.

- Find ways to increase your income or cut expenses, such as side hustles or reducing discretionary spending.

- Repeat and Gain Momentum:

- Once the smallest debt is paid off, move to the next smallest debt with the freed-up funds.

- Celebrate small wins to stay motivated.

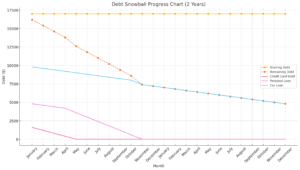

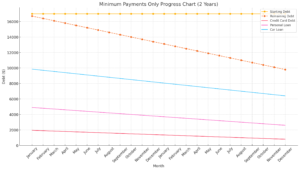

Comparing Debt Repayment Strategies: Debt Snowball vs. Minimum Payments

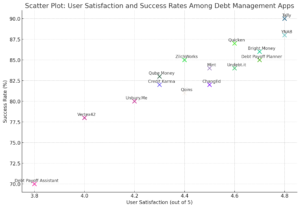

Debt Snowball Progress Chart (2 Years)

- Approach: Pay off smallest debts first.

- Overall Trend: Rapid debt reduction.

Minimum Payments Only Progress Chart (2 Years)

- Approach: Make only minimum payments.

- Overall Trend: Slow debt reduction

Key Takeaways

- Debt Snowball Method:

- Pros: Faster debt reduction, psychological boosts.

- Cons: Potentially higher interest costs.

- Minimum Payments Only:

- Pros: Simplicity, lower immediate burden.

- Cons: Slow progress, higher long-term costs.

The debt snowball method is better for quickly reducing debt and staying motivated.

Tips for Staying on Track

- Avoid Common Pitfalls: Resist the temptation of lifestyle inflation and avoid taking on new debt.

- Create a Support System: Share your goals with friends, family, or online communities for encouragement.

- Track Your Progress: Regularly review your debts and adjust your strategy as needed.

Leveraging Technology and Resources

Use technology to your advantage with apps and tools designed to help manage and pay off debt:

- Debt Payoff Planner: Helps you create a debt payoff plan and track your progress.

- Mint: Offers budgeting tools and expense tracking.

- YNAB (You Need A Budget): Helps you allocate every dollar and stay on top of your finances.

Follow financial influencers and educators who provide ongoing tips and motivation, such as Dave Ramsey, The Financial Diet, or YouTube channels focused on personal finance.

Real-Life Success Stories

Here are a couple of stories from Gen Z individuals who have successfully used the Debt Snowball Method:

- Emma: Paid off $10,000 in credit card debt in 18 months by focusing on her smallest debts first and using a side hustle to increase her income.

- Liam: Eliminated his student loans in three years by cutting down on non-essential expenses and using the Debt Snowball Method to stay motivated.

Lessons Learned:

- Small wins build confidence.

- Extra income sources can accelerate the debt payoff process.

- Staying disciplined and motivated is key.

Comparing Debt Snowball to Debt Avalanche

While both methods aim to help you get out of debt, they do so in different ways:

- Debt Snowball Method (Dave Ramsey):

- Focuses on paying off the smallest debts first.

- Provides quick psychological wins to maintain motivation.

- May result in paying more interest over time compared to the Debt Avalanche Method.

- Debt Avalanche Method (Suze Orman):

- Focuses on paying off debts with the highest interest rates first.

- Minimizes total interest paid over time.

- Financially efficient but may take longer to see psychological wins.

The Debt Snowball Method is a powerful tool to help you gain control over your finances and achieve financial freedom. By focusing on paying off your smallest debts first, you can build momentum and stay motivated throughout your debt repayment journey.

Take the first step today by listing all your debts and making a plan to tackle the smallest one. Share your progress, leave a comment with your questions or success stories, and follow our blog for more financial tips and advice.

Additional Resources

For personalized advice or coaching, contact us at [Your Contact Information].

How Understanding Credit Can Alleviate Financial Stress and Improve Mental Health

How Understanding Credit Can Alleviate Financial Stress and Improve Mental Health

Picture this: you, stepping out into the world, ready to take on new challenges. But instead of feeling excited, you're overwhelmed with stress. Sound familiar? If so, you’re not alone. Financial stress is a significant concern for many individuals, affecting not just their wallets but their mental health too. In this post, we'll dive into how learning about credit can be your secret weapon against financial stressors like job market uncertainty, low wages, the gig economy, and inflation. Understanding credit can lower your stress and improve your mental well-being. Ready to take control of your financial future and reduce stress? Let’s get started.

Job Market Uncertainty: The Anxiety Trigger

Navigating the job market today feels like trying to sail through a storm. With the aftermath of the COVID-19 pandemic, job opportunities are like elusive lifeboats. This uncertainty can wreak havoc on your peace of mind.

Mental Health Impact

- Anxiety: The constant worry about securing stable employment is like a cloud hanging over your head.

- Stress: Instability breeds chronic stress and uncertainty about the future.

Imagine having a financial cushion that catches you when you fall. That’s what a good credit score can do. By understanding credit, you can access personal loans or credit cards with favorable terms, helping you bridge income gaps during tough times.

Employment Rates vs. Stress Levels From 2019 to 2021, the employment rate fluctuated significantly. In 2019, the employment rate was at 70%. Fast forward to 2020, and it plummeted to 65% due to COVID-19. By 2021, it crept up to 67%. Meanwhile, stress levels soared by 30% from 2019 to 2020, with only a slight dip in 2021. These stats tell a story of why a financial safety net is crucial.

Low Wages: The Silent Depressor

You work hard, yet your paycheck feels like a trickle in an ocean of expenses. Low wages can make you feel like you’re running in place, unable to move forward financially.

Mental Health Impact

- Depression: Financial struggles can lead to feelings of hopelessness.

- Low Self-Esteem: When you can’t improve your situation, it’s easy to feel down on yourself.

What if you could use credit to boost your financial standing? With a strong credit history, you can secure low-interest loans, opening doors to educational opportunities or side businesses that supplement your income.

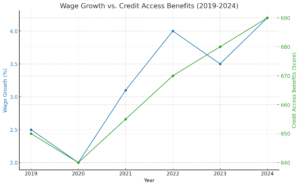

Eye-Opening Data: Wage Growth vs. Credit Access Wage growth is a modest 2% per year, but here’s the kicker: 40% of those with good credit scores can secure low-interest loans. These loans can fund education or entrepreneurial ventures, paving the way for a brighter financial future.

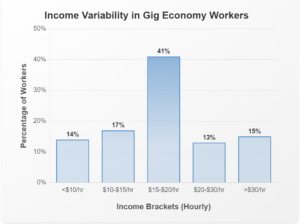

The Gig Economy: Flexibility’s Double-Edged Sword

The gig economy offers the allure of flexibility but often lacks the stability and benefits of traditional employment. The result? Financial unpredictability.

Mental Health Impact

- Stress: Irregular income streams create financial instability.

- Anxiety: The absence of benefits like health insurance adds to the financial burden.

Here’s where credit comes in as a game-changer. Good credit can help you access financial products that smooth out income variability, such as lines of credit or low-interest credit cards, providing a buffer during lean months.

Striking Facts: Income Variability in Gig Economy Workers Gig workers experience monthly income fluctuations ranging from 20% to 50%. However, 60% of those with good credit can stabilize their finances using lines of credit, reducing the stress associated with unpredictable earnings.

Inflation: The Stealthy Thief

Inflation is like a stealthy thief, slowly eroding your purchasing power. As prices rise, maintaining your standard of living becomes a juggling act.

Mental Health Impact

- Anxiety: Rising costs lead to constant worry about affording necessities.

- Stress: Stretching budgets further increases financial strain.

Understanding credit can help you combat inflation. Strategic use of credit can allow you to invest in assets that appreciate over time, preserving and even growing your wealth.

Compelling Insights: Inflation Rates vs. Financial Strategies Using Credit Inflation rates jumped from 2% in 2019 to a staggering 4.7% in 2021. Yet, 70% of individuals with good credit can use loans for investments that outpace inflation, such as real estate or education, helping to safeguard their financial future.

Financial stressors like job market uncertainty, low wages, the gig economy, and inflation can significantly impact your mental health. But here’s the good news: understanding credit and how to manage it effectively can be a powerful tool in your financial arsenal. By taking control of your credit, you can alleviate financial stress and pave the way for a more secure and mentally healthy future. So, why wait? Start your journey towards financial literacy today and watch as you reclaim control over your financial and mental well-being. Lowering your stress and improving your financial health is within your reach—take that first step now!

Master Your Credit: Fun Hacks and Challenges

Master Your Credit: Fun Hacks and Challenges

Ready to take control of your financial future? Dive into our ultimate guide for mastering credit and unlock your potential! Whether you're just starting your financial journey or looking to improve your existing credit, understanding and managing your credit score is crucial for achieving financial independence and securing future opportunities. But let's face it, the traditional advice can be dry and hard to relate to. That's why we've tapped into the real-life experiences of young influencers and entrepreneurs who have successfully navigated the credit landscape in creative and inspiring ways.

In this guide, you'll discover unconventional methods to build and manage your credit, learn from the mistakes of others, and find innovative tools to make the process fun and engaging. We'll share tips and tricks from those who've turned their credit into a powerful tool for personal and professional growth, showing you that with the right strategies, you can do the same.

Get ready to dive into a fresh, relatable, and practical approach to credit that speaks directly to your lifestyle and aspirations. Let's crush credit together!

Want to get started with our free PDF if so click the red button below

Why Credit Matters

Understanding why credit matters is the first step towards mastering it. Credit scores influence many aspects of our lives, often in ways we don’t immediately see. When I started out, I didn’t realize the far-reaching impact my early credit decisions would have. Even though I am successfully navigating credit now, my past choices still influence the decisions I make today. From securing loans to renting apartments, and even landing jobs, your credit score can have a significant impact. Here, we share real-life insights from influencers and entrepreneurs who have experienced firsthand how mastering credit has shaped their journeys.

Many successful individuals emphasize the importance of credit in achieving their dreams. For instance, building credit can allow you to finance initial purchases with favorable terms, such as buying your first car or furnishing an apartment, and can even help you secure your first apartment or negotiate better sponsorship deals. It's not just about loans; it's about leveraging opportunities to advance your career and personal life.

Starting a business often requires capital, and using credit wisely can help secure the initial funding and manage cash flow. Good credit scores also allow for obtaining favorable terms on business loans, enabling rapid and sustainable growth. Managing credit effectively is just as important as innovating products in running a successful business.

These diverse experiences underline the importance of credit in various facets of life and career. By learning from these stories, you can see how good credit management opens doors and creates opportunities, setting you up for long-term success.

Creative Ways to Build Credit Without Even Thinking About It

Building credit doesn’t have to be a daunting task. With the right strategies, you can integrate credit-building activities seamlessly into your everyday life. Here are some unconventional methods and hacks to help you build credit effortlessly.

Credit Building Tips

These creative methods make building credit a part of your daily routine without requiring extra effort. By incorporating these strategies, you can improve your credit score while focusing on your studies, career, and personal life.

Credit Challenges and Competitions: Making Credit Fun

Who said building credit has to be boring? By turning credit improvement into a game, you can stay motivated and make the process enjoyable. Credit challenges and competitions are excellent ways to engage with your friends and the wider community while working towards better credit. Here are some exciting ideas to get you started.

The Credit Score Race

Compete with friends to see who can improve their credit score the most over a set period, such as six months. Set specific goals, like paying off a certain amount of debt or reducing credit utilization, and track progress using credit monitoring tools.

Credit Card Rewards Hackathon

This challenge focuses on maximizing credit card rewards while maintaining responsible spending habits. Participants compete to see who can earn the most rewards points or cashback in a given period without increasing their debt.

Budgeting Bingo

Transform budgeting and credit management into a fun bingo game. Create bingo cards with different credit-related tasks, such as paying off a credit card balance, disputing an error on your credit report, or setting up automatic payments.

Social Media Credit Challenges

Leverage social media to create and participate in credit challenges. Use hashtags to track progress, share tips, and encourage others. This can create a supportive community focused on financial health.

By turning credit building into a series of engaging challenges and competitions, you can stay motivated and make the process enjoyable. These activities not only help improve your credit but also foster a sense of community and support. So, gather your friends, set some goals, and start making credit fun!

Credit Card Rewards: Maximizing Benefits for Travel, Shopping, and More

Credit cards can offer more than just a convenient way to make purchases—they can also provide valuable rewards that enhance your lifestyle. For instance, I have leveraged an airline credit card for everyday purchases, and my wife and I fly a few times a year for free. Whether you’re looking to travel, shop, or dine out, the right credit card can help you earn rewards that fit your interests. Here’s how to choose the best credit cards and maximize their benefits.

Finding the Right Credit Card

Choosing the right credit card depends on your spending habits and reward preferences. Here’s a breakdown of the types of credit cards that can help you maximize rewards:

Strategies to Maximize Rewards

Once you have the right credit card, it’s essential to use it strategically to maximize your rewards. Here are some tips to help you get the most out of your credit card:

- Focus on Bonus Categories: Many credit cards offer higher rewards rates for specific categories like dining, groceries, or travel. Make sure to use your card for these purchases to earn maximum rewards.

- Combine Cards: Use different cards for different spending categories to take advantage of each card’s bonus rewards.

- Pay in Full: Always pay your credit card balance in full each month to avoid interest charges, which can negate the value of your rewards.

- Redeem Smartly: Use your rewards for high-value redemptions, such as travel or gift cards, to get the most bang for your buck.

Leveraging Rewards for Business

For entrepreneurs, credit card rewards can provide significant benefits for business expenses. Using a business credit card with rewards tailored to your industry can help you save money and earn valuable perks.

- Business Travel Rewards: Choose a card that offers travel rewards if your business involves frequent travel. You can use the points or miles earned for flights, hotels, and other travel-related expenses.

- Cashback for Business Expenses: A cashback card can help offset the cost of regular business expenses like office supplies, advertising, and utilities.

- Employee Cards: Many business credit cards offer free employee cards, allowing you to earn rewards on their spending as well.

Avoiding Pitfalls

While credit card rewards can be highly beneficial, it’s essential to avoid common pitfalls that can undermine your efforts:

- Overspending: Don’t let the lure of rewards tempt you into spending more than you can afford.

- Carrying a Balance: Carrying a balance and incurring interest charges can quickly negate the value of your rewards.

- Ignoring Fees: Be aware of annual fees and other charges that might outweigh the benefits of the rewards.

By choosing the right credit card and using it strategically, you can earn valuable rewards that enhance your lifestyle and support your financial goals. Whether you’re looking to travel more, save on everyday expenses, or invest in your business, leveraging credit card rewards can help you achieve your objectives while building a strong credit history.

Want to get started with our free PDF if so click the red button below

Avoiding the Pitfalls: Common Credit Mistakes and How to Dodge Them

While building and managing credit can open many doors, it's easy to stumble into common pitfalls that can harm your financial health. Here, we’ll explore some frequent mistakes and provide practical advice on how to avoid them.

1. Overspending for Rewards

Credit card rewards can be enticing, but they shouldn’t encourage you to spend more than you can afford. Overspending to earn points or cashback can lead to carrying a balance and incurring interest charges, which can quickly outweigh the benefits of any rewards earned.

2. Missing Payments

One of the most damaging mistakes for your credit score is missing payments. Late payments can stay on your credit report for up to seven years and significantly lower your credit score.

3. Maxing Out Credit Cards

Using too much of your available credit, known as high credit utilization, can negatively impact your credit score. Aim to keep your credit utilization below 30% of your total credit limit

4. Applying for Too Many Cards at Once

Each time you apply for a credit card, a hard inquiry is made on your credit report, which can slightly lower your credit score. Multiple inquiries in a short period can have a more significant impact.

5. Ignoring Your Credit Report

Regularly checking your credit report is crucial for spotting errors or signs of identity theft. You’re entitled to a free credit report from each of the three major credit bureaus once a year through AnnualCreditReport.com.

6. Not Having a Credit Mix

Having a diverse mix of credit accounts (e.g., credit cards, installment loans, retail accounts) can positively impact your credit score. Lenders like to see that you can manage different types of credit responsibly.

7. Closing Old Credit Accounts

Closing old credit accounts can shorten your credit history and reduce your available credit, both of which can negatively affect your credit score. Unless there’s a compelling reason, it’s usually best to keep old accounts open.

8. Relying on Credit Repair Scams

Be wary of companies that promise quick fixes for your credit score for a fee. Many of these are scams and can’t deliver on their promises. Building good credit takes time and responsible financial behavior.

By understanding and avoiding these common credit mistakes, you can protect and improve your credit score, setting yourself up for financial success. Stay informed, be proactive, and use these tips to navigate your credit journey confidently.

Future-Proof Your Credit: Trends and Innovations to Watch

The world of credit is constantly evolving, and staying ahead of the curve can give you an edge in managing and improving your credit score. Here, we explore some emerging trends and innovations that are shaping the future of credit, along with insights on how these developments could impact your financial journey.

Alternative Credit Scoring Models

Traditional credit scoring models rely heavily on credit card and loan payment histories. However, new models are emerging that consider alternative data, such as utility payments, rent payments, and even social media activity. These models aim to provide a more comprehensive view of an individual's creditworthiness, especially for those with limited credit histories.

Fintech Innovations

Fintech companies are revolutionizing the credit landscape with innovative tools and services designed to make credit management easier and more accessible. Apps that offer credit score monitoring, personalized financial advice, and automated credit-building strategies are becoming increasingly popular.

Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later services, like Afterpay, Klarna, and Affirm, allow consumers to make purchases and pay for them in installments. While these services can be convenient, they can also impact your credit if not managed responsibly. Some BNPL services report to credit bureaus, which can help or hurt your credit score depending on your payment behavior.

Enhanced Credit Monitoring and Protection

As identity theft and data breaches become more common, enhanced credit monitoring and protection services are gaining importance. Many services now offer comprehensive identity theft protection, including real-time alerts, dark web monitoring, and identity restoration assistance.

Digital Credit Cards and Virtual Credit Lines

Digital credit cards and virtual credit lines are becoming more prevalent, offering greater security and flexibility. These digital solutions often come with advanced security features, such as temporary card numbers and real-time transaction alerts, reducing the risk of fraud.

AI-Powered Financial Advice

Artificial intelligence is playing a growing role in personal finance, offering tailored financial advice based on individual spending habits and financial goals. AI-powered platforms can help you optimize your credit usage, identify opportunities for improvement, and automate routine financial tasks.

Green and Ethical Credit Options

As sustainability becomes a priority for many consumers, green and ethical credit options are emerging. Some credit cards now offer rewards for environmentally friendly purchases or donate a portion of their profits to environmental causes.

By staying informed about these trends and innovations, you can future-proof your credit and take advantage of new opportunities to enhance your financial health. Embrace these changes and incorporate them into your credit strategy to stay ahead in the ever-evolving credit landscape.

Conclusion

Mastering your credit is one of the most empowering steps you can take toward achieving financial independence and securing a prosperous future. By understanding the importance of credit, utilizing creative ways to build it, engaging in fun challenges, maximizing credit card rewards, avoiding common pitfalls, and staying informed about emerging trends, you can set yourself up for long-term success.

Remember, building and maintaining good credit is a marathon, not a sprint. It requires consistent, responsible behavior and a proactive approach. Take the insights and tips shared in this guide to heart, and start implementing them in your daily life. Whether it's leveraging subscription services, participating in credit challenges with friends, or staying ahead of fintech innovations, every small step you take will contribute to a stronger financial foundation.

We encourage you to continue exploring the resources and tools available on our website. Share your credit-building journey with us and connect with a community of like-minded individuals who are also striving for financial success. Together, we can navigate the complexities of credit and achieve our financial goals.

So, let's get started—crush credit and pave the way for a bright financial future!

Want to get started with our free PDF if so click the red button below