Jeremiah

Chase Freedom Rise℠: Your Gen Z Credit Companion

Why This Card Could Be Your Next Power Move

Hey Gen Z! Looking to level up your financial game? Let's talk about why the Chase Freedom Rise℠ might be the perfect sidekick for your credit journey.

Building good credit is like unlocking a cheat code for your financial future. It can help you score better rates on loans, ace rental applications, and even impress potential employers. The Chase Freedom Rise℠ is designed to be your trusty companion in this quest, offering:

- A straightforward 1.5% cash back on all purchases (no complicated categories to track)

- Automatic credit limit reviews to help boost your credit-building potential

- No annual fee, because who wants to pay just to have a credit card?

The 411 on Chase Freedom Rise℠

How It Works (No Jargon, We Promise)

- Rewards System: Earn 1.5% cash back on every purchase, everywhere. Example: Buy a $4 latte, earn 6 cents. It might not sound like much, but it adds up!

- Credit Building Features: Get free credit score updates and automatic credit limit reviews. These features help you track your progress and potentially increase your credit limit over time, which can boost your credit score.

- Welcome Bonus: Earn a $50 bonus after your first purchase in the first 3 months. It's like getting paid to start building credit!

Top Perks That'll Make You Say "Yes Please"

- 1.5% Cash Back on Everything:

- Why it's cool: No need to remember which card to use where. This is your one-card-fits-all solution.

- Real talk: If you spend $500 a month (think groceries, gas, subscriptions), that's $90 cash back per year. Hello, new AirPods fund!

- $50 Bonus After First Purchase:

- Why it's cool: You don't need to spend a certain amount to get this bonus. Buy a pack of gum, get $50. Easy peasy.

- Pro tip: Use this bonus to start an emergency fund or invest in a low-cost index fund. Future you will be impressed.

- Credit Check-Ins and Limit Reviews:

- Why it's cool: Regular credit limit reviews mean you could get a higher limit without having to apply for a new card.

- Credit knowledge bomb: A higher limit can lower your credit utilization ratio, which can boost your credit score. It's like leveling up without doing extra work.

Watch Out For...

- No Intro APR Offer: Unlike some cards, there's no 0% intro APR period. If you carry a balance, interest kicks in right away.

- Limited Benefits Package: Don't expect fancy travel perks or high-end rewards. This card is more Honda Civic than Ferrari – reliable and practical, but not luxurious.

- Potentially Low Initial Credit Limit: As a starter card, your beginning credit limit might be on the lower side. But remember, those automatic reviews can help it grow over time.

Who's This Card For?

Perfect Match If You're:

- A credit newbie looking to build your score from scratch

- A college student wanting to start your credit journey (and earn some cash back on those textbook purchases)

- Someone who prefers simplicity in their financial tools

- A responsible spender who can commit to paying off the balance each month

Maybe Swipe Left If You're:

- An experienced credit user looking for premium perks

- A big spender who needs a high credit limit from day one

- Someone who travels frequently and wants travel-specific rewards

Pro Tips: Level Up Your Chase Freedom Rise℠ Game

Do This:

- Set Up Autopay:

- Why: Late payments are kryptonite for your credit score. Autopay ensures you never miss a due date.

- How: Log into your Chase account, go to "Automatic Payments," and set it up to pay at least the minimum (but aim for the full balance if you can).

- Use for Regular, Small Purchases:

- Why: This builds a positive payment history and keeps your utilization low.

- Idea: Set up your recurring subscriptions (Netflix, Spotify, etc.) on this card.

- Check Your Credit Score Regularly:

- Why: Watching your score improve is motivating, and it helps you catch any issues early.

- How: Use the free Chase Credit Journey tool. Set a monthly reminder to check it.

Don't Do This:

- Max Out Your Credit Limit: High utilization can hurt your score. Aim to use less than 30% of your available credit.

- Apply for Multiple Cards at Once: Each application can ding your credit score. Give it at least 6 months before considering another card.

- Treat Your Credit Limit Like Free Money: Credit card debt can snowball quickly with high interest rates. If you can't afford to pay for something with cash, don't charge it.

The Math: Making Chase Freedom Rise℠ Work for You

Scenario 1: The Everyday Spender

- Monthly spending: $500 (groceries, gas, subscriptions)

- Annual cash back: $500 x 12 months x 1.5% = $90

- Welcome bonus: $50

- Total first-year earnings: $140

Scenario 2: The Textbook Hero

- Semester textbook cost: $400

- Cash back on textbooks: $400 x 1.5% = $6

- Welcome bonus: $50

- Total savings: $56 (that's like getting a free textbook!)

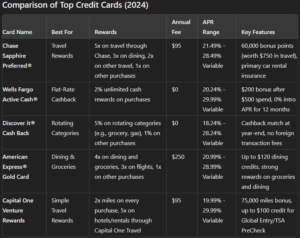

How Chase Freedom Rise℠ Stacks Up

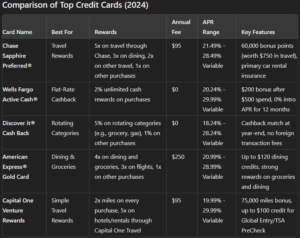

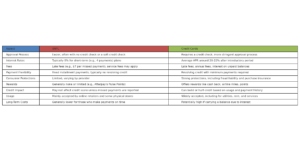

| Feature | Chase Freedom Rise℠ | Discover it® Secured | Capital One Platinum Secured |

|---|---|---|---|

| Annual Fee | $0 | $0 | $0 |

| Rewards Rate | 1.5% cash back on all purchases | 2% cash back at gas stations and restaurants (up to $1000 in combined purchases each quarter), 1% on all other purchases | No rewards |

| Welcome Bonus | $50 after first purchase | Cashback Match at the end of first year | N/A |

| Credit Building Features | Free credit score, automatic limit reviews | Free credit score, graduates to unsecured card | Credit limit increases possible after 6 months |

| Security Deposit Required | No | Yes | Yes, but can be as low as $49 |

FAQs

- Q: Can I get the Chase Freedom Rise℠ with zero credit history? A: Yes! This card is designed for people new to credit. However, you'll likely need some form of income to qualify.

- Q: What's the fastest way to boost my credit score with this card? A: Use the card regularly for small purchases, keep your utilization under 30%, and always pay on time. Consistency is key!

- Q: How do I avoid interest charges? A: Pay your full statement balance by the due date each month. This way, you'll never pay interest on your purchases.

- Q: Can I use this card internationally? A: Yes, but be aware of foreign transaction fees. This card may not be the best for frequent international travelers.

- Q: What happens if I miss a payment? A: You'll likely incur a late fee, and it could negatively impact your credit score. Set up autopay to avoid this!

Credit 101: Building Your Financial Foundation

Understanding credit is crucial for your financial future. Here's how the Chase Freedom Rise℠ fits into your credit-building strategy:

- Regular Use: Using the card for small, manageable purchases helps build a positive payment history.

- On-Time Payments: The autopay feature helps ensure you never miss a payment, which is crucial for your credit score.

- Credit Utilization: As your credit limit potentially increases over time, it can help lower your credit utilization ratio, positively impacting your score.

- Credit Monitoring: The free credit score updates help you track your progress and understand factors affecting your credit.

Remember, a good credit score can open doors to better financial opportunities in the future, from lower interest rates on loans to better insurance premiums.

Final Thoughts: Is Chase Freedom Rise℠ Your Card Soulmate?

The Chase Freedom Rise℠ is like that reliable friend who's always got your back. It's not the flashiest card out there, but it's a solid choice for Gen Z-ers just starting their credit journey.

Here's the bottom line:

- It's great for building credit with its user-friendly features

- The rewards are simple but valuable

- There's no annual fee to worry about

If you're ready to start building your credit and earning some cash back along the way, the Chase Freedom Rise℠ could be your perfect match. It offers a balanced mix of credit-building features and rewards, ideal for those new to the credit game.

Ready to take the plunge? Head over to Chase's website for the full details or to apply. And remember, future you will thank present you for making smart financial moves today!

Disclaimer: This guide is for informational purposes only. Always read the terms and conditions carefully before applying for any credit card. Your financial journey is unique, so consider talking to a financial advisor to make the best decision for your situation.

💰

Building Credit from Scratch: How Chase Freedom Rise℠ Can Help Gen Z Thrive

What You Need to Know About the Chase Freedom Rise℠

1. The Basics: How the Chase Freedom Rise℠ Works The Chase Freedom Rise℠ is designed to offer simplicity and utility for beginners. With 1.5% unlimited cashback on every purchase, it eliminates the hassle of tracking rotating categories or spending thresholds. This card also provides an automatic credit line review after six months, offering the chance for a credit limit increase, which can help you build your credit score more efficiently.

2. Top Benefits of the Chase Freedom Rise℠

- Universal 1.5% Cashback: No matter where you swipe, you'll earn 1.5% cashback on every dollar spent. This straightforward reward structure is perfect for those just getting started with credit cards.

- No Annual Fee: There are no hidden costs or annual fees, allowing you to focus entirely on building credit and accumulating rewards without worrying about extra charges.

- Credit Monitoring Tools: Free access to your credit score and other credit-building tools via Chase Credit Journey helps you keep track of your progress and stay informed.

3. Potential Drawbacks: What to Watch Out For

- High APR: Like many entry-level credit cards, the Chase Freedom Rise℠ has a relatively high APR, which could be costly if you carry a balance. Paying off your balance each month is crucial to avoid interest charges.

- Modest Rewards Compared to Premium Cards: While the 1.5% cashback is solid for a beginner card, it doesn’t compete with the higher rewards rates or exclusive perks offered by premium credit cards.

Who Should Get the Chase Freedom Rise℠?

1. Ideal for Gen Z Newbies to Credit This card is specifically tailored for Gen Z individuals starting their credit journey. If you’re fresh out of college or just beginning to manage your finances independently, the Chase Freedom Rise℠ offers a low-risk, high-reward entry point into the world of credit cards.

2. Not Ideal for High Spenders or Frequent Travelers For those who have already built some credit or who spend heavily in specific categories like travel, a card with higher rewards rates or travel-specific perks might be more beneficial.

How to Maximize Your Chase Freedom Rise℠

1. Tips and Tricks

- Leverage Everyday Spending: Use your card for routine purchases—like groceries, gas, and dining out—to maximize your cashback. With 1.5% cashback on everything, every purchase adds up.

- Pay in Full Monthly: To avoid the high interest rates, make it a habit to pay off your balance in full every month. This practice not only saves you money but also helps build your credit score faster.

- Monitor Your Credit Growth: Use the free tools provided by Chase Credit Journey to monitor your credit score regularly. Understanding your credit behavior and its impact is key to building a solid financial foundation.

2. Avoiding Common Pitfalls

- Resist Overspending: The allure of easy cashback can tempt you to overspend. Stick to your budget to ensure that you’re only spending what you can pay off each month.

- Keep Track of Due Dates: Missing a payment can lead to penalties and hurt your credit score. Set up automatic payments or reminders to avoid late payments.

Best Credit Cards for Beginners

1. Chase Freedom Rise℠: Best for Building Credit This card stands out for its balanced mix of simplicity, cashback rewards, and credit-building features, making it an excellent choice for Gen Z beginners. With no annual fee and straightforward rewards, it’s designed to help you build a strong credit foundation.

2. Petal® 2 "Cash Back, No Fees" Visa® Credit Card Another strong contender, the Petal® 2 card is perfect for those without a credit history. It offers 1-1.5% cashback with no fees, making it a solid alternative for those who prioritize simplicity and low costs.

3. Discover it® Secured Credit Card For those who might need a secured option, the Discover it® Secured Credit Card is a top choice. It provides cashback rewards while helping you build credit with a refundable security deposit.

Final Thoughts: Is the Chase Freedom Rise℠ Right for You?

The Chase Freedom Rise℠ is an excellent choice for anyone new to credit cards, particularly Gen Z. Its combination of no annual fee, universal cashback, and credit-building tools offers a robust platform for starting your financial journey. If you’re looking for a straightforward card that will help you build credit and earn rewards along the way, the Chase Freedom Rise℠ is definitely worth considering.

FAQs About the Chase Freedom Rise℠

1. Can I get the Chase Freedom Rise℠ with no credit history? Yes, the Chase Freedom Rise℠ is designed with beginners in mind, making it accessible even if you have limited or no credit history.

2. How can I avoid paying interest? Avoid interest charges by paying off your full balance each month before the due date. This practice not only saves money but also helps in building a positive credit history.

3. Does the Chase Freedom Rise℠ have any annual fees? No, there are no annual fees associated with this card, allowing you to focus on building credit without any added financial burden.

This comprehensive guide elevates the Chase Freedom Rise℠ as a top choice for Gen Z looking to establish credit. It balances practical advice with the key features and benefits of the card, ensuring that you're well-equipped to make an informed decision on your financial journey

How to Dodge the Credit Card Debt Trap and Still Live Your Best Life 🚫💳💸

Yo, fellow Gen Z-ers! 📱✨ Did you know that the average millennial is out here carrying over $5K in credit card debt? Big yikes! 😬 But don't stress, fam. We're about to spill the tea on how to keep your finances on fleek without falling into the credit card trap. Whether you're just starting your adulting journey or you're already grinding in your career, this guide's got your back. Let's get this bread responsibly! 🍞💪

Credit Cards: BFF or Toxic Friend? 🤔

Credit cards can be your ride-or-die or your worst nightmare. It's all about how you use them. Let's break it down:

Credit Card 101: The Basics

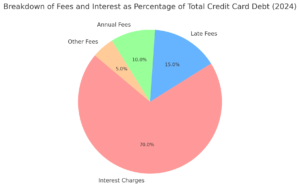

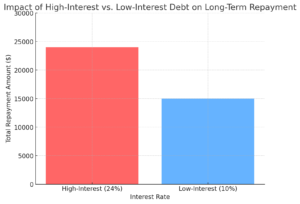

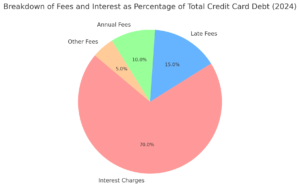

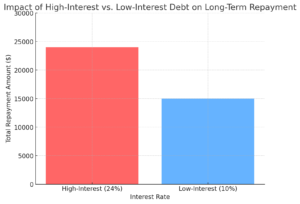

- APR (Annual Percentage Rate): This is the interest you'll pay if you don't clear your balance. If your card's APR is 20% and you're carrying a balance, you could end up paying hundreds or even thousands more than what you originally spent. Not cool, bro.

- Fees: Watch out for those sneaky fees – late fees, annual fees, and over-limit fees. They can add up faster than TikTok views on a viral dance challenge.

- Credit Limits: This is the max you can spend on your card. Go over it, and you're in for a bad time – penalties and a hit to your credit score. Oof.

Common Credit Card Traps (Don't Get Caught Slipping!)

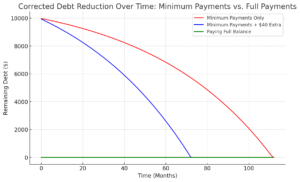

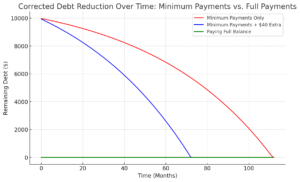

- Minimum Payments: Paying just the minimum each month? That's a trap. The rest of your balance is growing interest faster than your houseplants (if you're actually keeping them alive).

- Lifestyle Inflation: Getting that bag at your new job? Don't let your spending go wild just 'cause your credit limit went up. That's a one-way ticket to Debt City, population: you.

- Multiple Credit Cards: Having more cards than you can keep track of is like trying to watch all your TikTok FYP in one sitting – overwhelming and probably not great for your health.

Using Credit Cards Like a Boss 😎

Your credit card can be a power-up in your financial game if you know how to use it right.

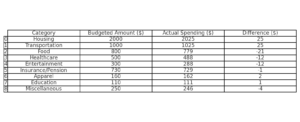

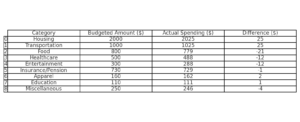

Budgeting and Expense Tracking: Keep It 100

- Create a Budget: Allocate your coins for the essentials, the fun stuff, and savings. Make sure you've got room for those credit card payments – you want to pay them off in full each month, no cap.

- Track That Spend: Use apps like Mint, YNAB, or PocketGuard to keep an eye on where your money's going. It's like having a financial fitness tracker, but for your wallet.

Paying Off Balances: Don't Let That Interest Catch You Slipping

- Full Balance Payments: Pay off your whole balance every month. It's the ultimate flex – no interest charges, no debt accumulation. You're basically telling interest "Thank u, next."

- Debt Repayment Strategies: If you're already in the debt game, try the snowball method (paying off smallest debts first) or the avalanche method (highest interest rates first). Pick your fighter and stick to it.

Use Credit Cards for Necessities Only: Keep It Essential

- Stick to the Basics: Use your card for things you need, like groceries, gas, and bills. It's not for funding your entire Coachella experience or your Supreme merch addiction.

- The "Two-Week Rule": For non-essential purchases, wait two weeks before buying. If you still want it after that, maybe it's worth it. But probably not.

Build an Emergency Fund: Your Financial Safety Net

- Savings Goal: Aim to save enough to cover 3-6 months of living expenses. It's your "in case of emergency, break glass" fund, but for money.

- Automated Savings: Set up auto-transfers to your savings account every payday. It's like meal prepping, but for your bank account.

Avoiding Debt Traps: Don't Get Caught in the Web 🕸️

Even the most financially savvy can fall into debt traps. Here's how to stay woke:

Recognizing High-Interest Debt: The Silent Killer

- Interest Rates: Credit card interest rates can be higher than your screen time. We're talking 15% to over 30%. Carrying a balance on these is like setting your money on fire.

- Payoff Prioritization: Focus on paying down the high-interest debt first. It's like defeating the final boss in a video game – take out the biggest threat first.

Avoiding Cash Advances: The Ultimate No-No

- Fees and Immediate Interest: Cash advances are the Darth Vader of credit card features. High fees, immediate interest, and generally bad vibes. Avoid them like you avoid your ex's Instagram stories.

- Alternatives: Look into personal loans or use your emergency fund instead. They're usually less likely to wreck your financial future.

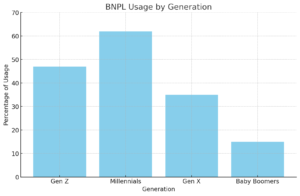

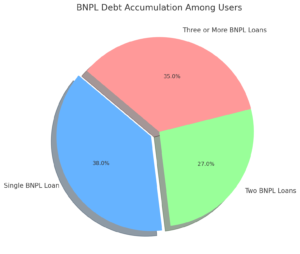

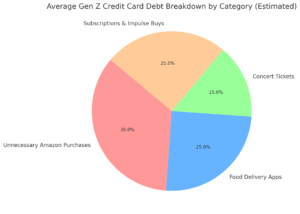

Being Cautious with 'Buy Now, Pay Later' Services: The New Kid on the Block

- Temptation to Overspend: BNPL services are like that friend who always convinces you to go out when you should be staying in. Convenient, but dangerous for your wallet.

- Debt Accumulation: Those small payments can add up faster than your unread emails. Always ask yourself if you really need it and if you can actually afford it.

- Read the Fine Print: Don't just scroll and accept. Actually read those terms and conditions. It's not as fun as reading your horoscope, but way more important.

Maximizing Credit Card Benefits Without the Debt Drama

You can still get those sweet, sweet credit card perks without drowning in debt. Here's how:

Choosing the Right Card: Pick Your Player

- Assess Your Needs: Look for cards that vibe with your spending habits and financial goals. Just starting out? Consider a student or secured credit card with no annual fee.

- Reward Programs: Choose a card with rewards that match your lifestyle. Whether it's cashback on groceries, points for travel, or discounts on your daily cold brew addiction.

Maximizing Rewards: Get Those Perks

- Responsible Spending: Use your card for regular expenses you'd be making anyway. It's like getting extra XP for tasks you were already doing in a game.

- Avoid Chasing Rewards: Don't spend more just to get rewards. If you wouldn't buy it without the rewards, it's probably not worth it. Don't play yourself.

Psychological and Behavioral Tips: Mind Over Money 🧠💰

Your mind is your most powerful tool in avoiding debt. Let's hack your brain for financial success:

Mindful Spending: Stay Woke with Your Wallet

- Wants vs. Needs: Before you buy something, ask yourself if it's a want or a need. It's like Marie Kondo-ing your spending habits.

- The 24-48 Hour Rule: Wait a day or two before making non-essential purchases. It's like letting your crush's text sit for a bit before replying – if you still want it after the wait, maybe it's worth it.

- Regular Reviews: Schedule financial check-ins with yourself. It's like having a DTR (Define The Relationship) talk, but with your money.

Managing Peer Pressure and Social Media Influence: Don't Let the FOMO Get You

- The Social Media Trap: Instagram and TikTok can make you feel like you need to ball out to keep up. Remember, it's all filters and good lighting.

- Stay Grounded: Focus on your own financial goals. Your future self will thank you more than your followers ever could.

- Set Boundaries: Maybe unfollow those accounts that make you want to spend. Follow some financial literacy accounts instead. It's like a social media cleanse, but for your wallet.

Level Up Your Money Game: Financial Education for the Win 🧠💰

Staying ahead in the money game is all about that continuous learning grind. Here's how to keep your financial knowledge fresh:

Become a Financial Content Junkie 🎧📚

- Learn on the Daily: Make consuming financial content your new guilty pleasure. Swap out some of your TikTok time for money tips. Whether it's podcasts during your commute, finance blogs while you're waiting for your latte, or books before bed – get that financial wisdom flowing!

- Knowledge is Your Superpower: The more you learn, the more confident you'll be flexing those money management muscles. It's like leveling up in a video game, but for your bank account. Debt traps? You'll be dodging them like Neo in The Matrix.

Financial Resources That Don't Suck 🔥

Ready to turn your brain into a money-making machine? Check out these fire resources that'll have you speaking fluent finance in no time:

Podcasts for Your Ears 🎙️

- The Stacking Benjamins Show: It's like hanging out with your hilarious, financially savvy friend. They cover everything from investing to saving, and it's so fun you'll forget you're learning. Perfect for when you're pretending to work out at the gym.

- Afford Anything: Hosted by Paula Pant, this podcast is your ticket to financial independence. It's like a cheat code for life, giving you the inside scoop on smart money moves, real estate investing, and designing a life that doesn't suck.

Blogs to Bookmark 💻

- Mr. Money Mustache: This blog is the OG of financial independence and frugal living. It's like your cool uncle who teaches you how to live your best life while stacking that paper. Practical advice that'll have you building wealth faster than you can say "avocado toast."

- Get Rich Slowly: For those of us who aren't about to win the lottery anytime soon, this blog is all about the slow and steady approach to getting that bag. Smart saving, investing tips, and financial planning that'll have you achieving financial freedom without feeling like you're living under a rock.

Books That Won't Put You to Sleep 📚

- "The Total Money Makeover" by Dave Ramsey: This isn't your grandpa's finance book. Dave Ramsey serves up a step-by-step guide to financial glow-ups with zero filter. It's perfect for anyone ready to take control of their financial destiny and tell debt to take a hike.

- "Your Money or Your Life" by Vicki Robin and Joe Dominguez: Want to transform your relationship with money faster than a Kardashian changes outfits? This book is your go-to. It's all about achieving that financial independence and living your best life. A must-read for anyone looking to zhuzh up their money mindset.

So there you have it, fam! With these resources in your arsenal, you'll be on your way to becoming a financial wizard faster than you can say "compound interest." Now go forth and get that bread! 🍞💸

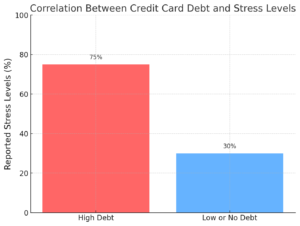

Mental Health Impacts: It's Not Just About the Benjamins

Your relationship with credit cards can affect your mental health. Let's talk about it:

Positive Mental Health Impacts: The Good Vibes

- Financial Confidence: Successfully managing your credit card is a major flex. Watching your credit score go up is like leveling up in real life.

- Stress Reduction: Knowing you have a credit card for emergencies can be a real stress-buster. It's like having a financial security blanket.

Negative Mental Health Impacts: The Dark Side

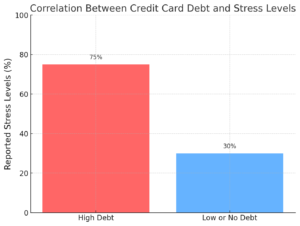

- Stress and Anxiety: Debt can be a major source of stress. It's like having a cloud of doom following you around.

- Guilt and Regret: Overspending can lead to some serious feels. It's the financial equivalent of texting your ex at 2 AM.

- Relationship Strain: Money problems can put a real damper on your relationships. It's like bringing a third wheel on all your dates, but the third wheel is debt.

Balancing Credit Card Use with Mental Well-being: Find Your Zen

- Mindful Spending: Practice mindful spending to avoid the emotional rollercoaster of debt.

- Seek Help When Needed: If you're feeling overwhelmed, don't be afraid to reach out. There are pros who can help you manage both your money and your mind.

- Regular Check-ins: Do mental health check-ins along with your financial ones. It's like checking your horoscope, but actually useful.

The Ultimate Financial Vibe Check 💸🧠

Yo, it's time for a financial vibe check! Use this checklist to see how your money sitch is messing with your mental health. It's like a mood ring, but for your wallet and your mind. Let's get introspective! 🤔💭

| Vibe Category | Check Yourself Before You Wreck Yourself |

|---|---|

| 💡 Stress-o-Meter |

|

| 🌈 Emotional Rollercoaster |

|

| 🔄 Stress-Busting Moves |

|

| 👥 Squad Goals Check |

|

| 💪 Body Check |

|

| 💼 Money Boss Status |

|

| 🔮 Future You Vibes |

|

| 🤝 Your Financial Fam |

|

Real-Life Examples: Learn from the OGs

Let's take a page from those who've been there, done that:

Success Stories

Emily's Strategy: The Budget Queen 👑

Background: Emily, mid-20s, avoided debt by budgeting like a boss.

Key Strategies:

- Budgeting: Used the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt).

- Paying Off Balances: Cleared credit card balances monthly like she was clearing her inbox.

- Debt Prioritization: Focused on those high-interest student loans like a laser.

- Emergency Fund: Built a 6-month cushion, because adulting is unpredictable.

- Rewards Cards: Used strategically for everyday purchases, racking up those points.

Outcome: Emily paid off her loans early and kept her finances healthier than her plant collection.

Mark's Debt-Free Journey: The Frugal Flexer 💪

Background: Mark, 29, resisted lifestyle inflation despite making bank.

Key Strategies:

- Debt Repayment: Tackled high-interest credit card debt first, like a financial ninja.

- Lifestyle Control: Lived modestly despite income increases. No flexing on the 'gram for him.

- Automated Savings: Set up auto-transfers for savings and debt. Set it and forget it, like your Spotify playlist.

- Smart Credit Use: Used cards for rewards, paying off balances monthly. No interest for this smart cookie.

- Emergency Fund: Built an 8-month reserve. He's ready for anything, even another toilet paper shortage.

Outcome: Mark became debt-free in two years and now uses credit cards like a pro.

You Got This! 🚀

Alright, squad, let's wrap this up. Your financial future is in your hands – don't let credit card debt cramp your style. By using these strategies, you can avoid the debt traps that many of us fall into. Take action today: check your credit card use, set some financial goals (maybe "save enough for a PS5 AND pay off my card"?), and start implementing these tips.

Remember, credit cards are a tool, not a ticket to YOLO spending. Use them wisely, and you'll be building a financial future so bright, you'll need shades. Now go forth and conquer, you financially savvy icon! 💯✨

How to Avoid the Credit Card Debt Trap as a Young Professional

Did you know that the average millennial carries over $5,000 in credit card debt? While credit cards offer convenience and rewards, they can quickly become a financial nightmare if not managed wisely. As a young professional, your financial decisions now will shape your future. The good news? With the right strategies, you can sidestep the pitfalls and take full control of your financial journey. This guide will show you how to navigate the complexities of credit card use, avoid common debt traps, and maintain both your financial and mental well-being.

Understanding Credit Cards: Friend or Foe?

Credit cards can be your best friend or your worst enemy. It all comes down to how well you understand their mechanics and risks. Here’s a breakdown of the essentials:

Credit Card Basics

Credit cards are a convenient tool for managing short-term finances and building credit, but they also come with significant risks:

- APR (Annual Percentage Rate): This is the interest rate charged on any unpaid balance. For example, if your credit card has an APR of 20% and you carry a balance, you could end up paying hundreds or even thousands more than your original purchase over time.

- Fees: Credit cards often come with various fees—late fees, annual fees, and fees for exceeding your credit limit. These can add up quickly and contribute to debt accumulation.

- Credit Limits: Your credit limit is the maximum amount you can borrow on your card. Exceeding this limit can result in penalties and negatively impact your credit score.

Common Pitfalls of Credit Card Use

Many young professionals fall into these traps:

- Minimum Payments: Paying only the minimum amount due each month might seem like a way to stay on top of your finances, but it’s a trap. The remaining balance accrues interest, which can significantly increase the amount you owe over time.

- Lifestyle Inflation: As your income grows, so might your spending—especially if you rely on credit cards to fund a more luxurious lifestyle. This can lead to mounting debt that becomes harder to manage.

- Multiple Credit Cards: It’s easy to lose track of spending when you have multiple cards. This can lead to overspending and make it difficult to keep up with payments.

Smart Credit Card Usage: Wield Your Power Wisely

Your credit card is a powerful tool—if you know how to wield it wisely.Using credit cards strategically rather than impulsively can make all the difference in avoiding debt.

Budgeting and Tracking Expenses

Creating and sticking to a budget is crucial for managing credit card use:

- Budget Creation: Allocate specific amounts for essential expenses, discretionary spending, and savings. Your budget should include a line item for credit card payments, ensuring you don’t exceed what you can afford to pay off in full each month.

- Expense Tracking: Apps like Mint, YNAB (You Need A Budget), and PocketGuard help you monitor your spending in real-time. Regularly reviewing your spending helps you stay within budget and avoid surprise balances on your credit card statement.

Paying Off Balances

To avoid the credit card debt trap, it’s essential to pay off your balance in full every month:

- Full Balance Payments: Paying off your full balance each month prevents interest charges from accumulating. It’s a simple yet powerful habit that can save you hundreds in interest over the long term.

- Debt Repayment Strategies: If you’re already in debt, consider the snowball method (paying off the smallest debts first) to gain quick wins and build momentum. Alternatively, the avalanche method (paying off debts with the highest interest rates first) can save you the most money in the long run.

Use Credit Cards for Necessities Only

One of the best ways to avoid debt is to use credit cards only for essential purchases:

- Necessities: Limit your credit card use to necessary expenses like groceries, gas, and utility bills. This helps you keep spending under control and ensures that you can pay off your balance each month.

- The “Two-Week Rule”: For non-essential purchases, wait two weeks before buying. This delay helps curb impulse buying and gives you time to determine whether the purchase is truly necessary.

Build an Emergency Fund

An emergency fund is your financial safety net:

- Savings Goal: Aim to save three to six months’ worth of living expenses. This fund ensures that you don’t have to rely on credit cards to cover unexpected expenses, like car repairs or medical bills.

- Automated Savings: Set up automatic transfers to your savings account each payday. This helps you build your emergency fund consistently without having to think about it.

Avoiding Debt Traps: Don’t Get Caught

The path to debt is paved with good intentions.Even the most financially savvy can fall into debt traps. Here’s how to steer clear:

Recognizing High-Interest Debt

Carrying balances on high-interest credit cards is a fast track to financial trouble:

- Interest Rates: Credit card interest rates can range from 15% to over 30%. Carrying a balance on high-interest cards can quickly inflate your debt, making it harder to pay off.

- Payoff Prioritization: Focus on paying down high-interest debt first. Use the avalanche method to tackle the most expensive debt, which will save you the most money over time.

Avoiding Cash Advances

Cash advances are one of the most expensive forms of credit:

- Fees and Immediate Interest: Cash advances typically come with high fees and start accruing interest immediately—often at a higher rate than regular purchases. Avoid them whenever possible.

- Alternatives: Instead of taking a cash advance, consider personal loans or using your emergency fund. These options usually have lower interest rates and more favorable terms.

Visual Aid: A comparison chart showing the costs associated with cash advances versus other borrowing options like personal loans.

Being Cautious with 'Buy Now, Pay Later' Services

“Buy Now, Pay Later” (BNPL) services are growing in popularity, but they come with risks:

- Temptation to Overspend: BNPL services make it easy to buy now and pay later, but this convenience can lead to overspending and accumulating debt across multiple platforms.

- Debt Accumulation: Small, manageable payments can add up quickly if you’re not careful. Always consider whether you truly need the item and if you can afford to pay for it in full.

- Read the Fine Print: Be aware of the terms and conditions, including any late fees or penalties for missed payments.

Visual Aid: An infographic highlighting the risks of BNPL services and tips for using them responsibly.

Maximizing Credit Card Benefits Without Accumulating Debt

Credit cards don’t have to be a debt sentence. When used strategically, they can offer valuable rewards and benefits without leading you into debt.

Choosing the Right Card

Selecting the right credit card is the first step toward responsible credit use:

- Assess Your Needs: Look for cards that align with your spending habits and financial goals. If you’re just starting out, consider a student or secured credit card with no annual fee.

- Reward Programs: Choose a card with rewards that match your lifestyle—whether it’s cashback on groceries, points for travel, or discounts on everyday purchases. Avoid cards with high annual fees unless the benefits significantly outweigh the costs.

Maximizing Rewards

Credit card rewards can be a great benefit, but only if you’re not paying interest on them:

- Responsible Spending: Use your credit card for regular expenses you’d be making anyway, like gas and groceries. Pay off the balance in full each month to avoid interest charges.

- Avoid Chasing Rewards: Don’t fall into the trap of overspending just to earn rewards. If you wouldn’t buy it without the rewards, it’s probably not worth it.

Psychological and Behavioral Tips: Master Your Mindset

Your mind is the most powerful tool in avoiding debt.Understanding the psychology behind spending can help you stay in control of your finances.

Mindful Spending

Mindful spending is about being intentional with your money:

- Distinguish Wants from Needs: Before making a purchase, ask yourself if it’s a want or a need. This simple practice can prevent unnecessary spending.

- The 24-48 Hour Rule: Wait 24-48 hours before making any non-essential purchase. This gives you time to reflect on whether the purchase is truly necessary or just an impulse.

- Regular Reviews: Schedule regular check-ins with yourself to review your spending habits. Adjust your budget and goals as needed.

Mindful Spending Checklist

Before making any purchase, pause and reflect with these essential questions to ensure you're making wise financial choices:

Managing Peer Pressure and Social Media Influence

Social media can be a major driver of impulse spending:

- The Social Media Trap: Platforms like Instagram and TikTok often showcase curated, idealized versions of life that can make you feel like you need to spend more to keep up.

- Stay Grounded: Remember that social media often shows only the highlights, not the full picture. Focus on your financial goals and what’s important to you, rather than trying to keep up with others.

- Set Boundaries: Consider limiting your exposure to social media or following accounts that promote financial wellness instead of consumerism.

Continuous Financial Education

Ongoing financial education is key to staying ahead:

- Learn Continuously: Make a habit of consuming financial content regularly. This could be through podcasts, blogs, or books focused on personal finance.

- Empower Yourself: The more you learn, the more confident you’ll be in managing your money and avoiding debt traps. Knowledge is power, especially when it comes to financial decision-making.

Recommended Financial Resources

Enhance your financial knowledge with these handpicked resources, including insightful podcasts, blogs, and books. Whether you're just starting your financial journey or looking to deepen your understanding, these resources offer valuable guidance.

Podcasts

- The Stacking Benjamins Show

A light-hearted podcast that covers a wide range of financial topics, from investing to saving strategies. With expert guest interviews, it’s perfect for anyone looking to gain financial wisdom in a fun and engaging way. - Afford Anything

Hosted by Paula Pant, this podcast explores the concept of financial independence and provides actionable tips on smart money decisions, real estate investing, and lifestyle design.

Blogs

- Mr. Money Mustache

Dive into the world of financial independence and frugality with Mr. Money Mustache. This blog offers practical advice on how to live a more efficient and purposeful life while building wealth. - Get Rich Slowly

Focused on the gradual approach to wealth building, this blog provides insightful articles on smart saving, investing, and financial planning, helping readers achieve financial freedom at their own pace.

Books

- “The Total Money Makeover” by Dave Ramsey

A step-by-step guide to financial fitness, offering practical advice on getting out of debt and building wealth. Dave Ramsey’s no-nonsense approach is ideal for anyone looking to take control of their financial future. - "Your Money or Your Life” by Vicki Robin and Joe Dominguez

This book is a comprehensive guide to transforming your relationship with money, achieving financial independence, and living more intentionally. It’s a must-read for those looking to rethink their financial habits.

Mental Health Impacts of Credit Card Use: The Good and the Bad

Credit card debt doesn’t just affect your wallet—it can take a toll on your mental health.Understanding these impacts can help you make better financial choices.

Positive Mental Health Impacts

Using credit cards responsibly can actually benefit your mental health:

- Financial Confidence: Successfully managing your credit card builds self-esteem and confidence in your financial abilities. It’s empowering to see your credit score rise and know that you’re in control.

- Stress Reduction: Knowing that you have a credit card as a backup for emergencies can reduce anxiety. It’s a safety net that can give you peace of mind in uncertain situations.

Negative Mental Health Impacts

On the flip side, credit card debt can have serious negative effects on your mental health:

- Stress and Anxiety: Debt can be a major source of stress, leading to anxiety and even depression. The constant worry about how to make payments or how much interest is accruing can be overwhelming.

- Guilt and Regret: Overspending on credit cards often leads to feelings of guilt and regret. This emotional burden can make it harder to break out of the cycle of debt.

- Relationship Strain: Financial stress is one of the leading causes of relationship problems. Debt can lead to secrecy, mistrust, and conflict, putting a strain on personal relationships.

Balancing Credit Card Use with Mental Well-being

It’s crucial to balance your financial health with your mental well-being:

- Mindful Spending: By practicing mindful spending, you can avoid the emotional toll of debt and maintain a healthy relationship with your finances.

- Seek Help When Needed: If you’re feeling overwhelmed by debt, don’t hesitate to seek professional advice or counseling. There are financial counselors who specialize in helping people manage debt, and mental health professionals who can help you cope with the stress.

- Regular Check-ins: Incorporate mental health check-ins into your financial routine. Reflect on how your financial situation is affecting your mental well-being and make adjustments as needed.

Financial Well-Being and Mental Health Check-In Checklist

Use this checklist regularly to assess how your finances might be affecting your mental health. It’s a great way to reflect on your financial habits and how they impact your well-being.

| Category | Checklist Items |

|---|---|

| Stress Levels |

|

| Mood and Emotions |

|

| Coping Mechanisms |

|

| Impact on Relationships |

|

| Physical Health |

|

| Financial Control |

|

| Future Outlook |

|

| Support Systems |

|

Real-Life Examples: Learn from Others

Learn from those who’ve been there—real stories can guide your financial journey.

Success Stories

-

Emily's Strategy

Background: Emily, in her mid-20s, avoided debt by budgeting carefully.

Key Strategies:

- Budgeting: Used the 50/30/20 rule.

- Paying Off Balances: Cleared credit card balances monthly.

- Debt Prioritization: Focused on high-interest student loans.

- Emergency Fund: Built a 6-month cushion.

- Rewards Cards: Used strategically for everyday purchases.

Outcome: Emily paid off her loans early and maintained a healthy financial cushion.

Mark's Debt-Free Journey

Background: Mark, 29, resisted lifestyle inflation despite a good salary.

Key Strategies:

- Debt Repayment: Prioritized high-interest credit card debt.

- Lifestyle Control: Lived modestly despite income increases.

- Automated Savings: Set up automatic transfers for savings and debt.

- Smart Credit Use: Used cards for rewards, paying off balances monthly.

- Emergency Fund: Built an 8-month reserve.

Outcome: Mark became debt-free within two years and uses credit wisely.

Key Takeaways:

- Budgeting: Essential for avoiding debt.

- Prioritizing High-Interest Debt: Saves money in the long run.

- Emergency Fund: Provides financial security.

- Smart Credit Use: Maximizes benefits without incurring debt.

Take Control of Your Financial Future

Your financial future is in your hands—don’t let credit card debt take control.

By applying the strategies discussed in this guide, you can avoid the common debt traps that many young professionals face. Take action today by assessing your current credit card use, setting financial goals, and implementing the tips we’ve covered. Remember, credit cards are a tool, not a ticket to debt. Use them wisely, and you’ll build a strong financial foundation that will serve you well into the future.

Assess your current credit card situation—are you using your cards strategically? Set some financial goals for the next year and consider how your credit card habits align with these goals. Start implementing the tips discussed in this post to avoid falling into the credit card debt trap.

Why Gen Z Should Care About Fintech in 2024

Introduction

Imagine managing your finances without ever setting foot in a bank. For Gen Z, this isn't just a possibility—it's a preference. Born into a world of smartphones and instant access, this generation is reshaping the financial landscape by embracing fintech, a rapidly growing sector that combines finance with cutting-edge technology. Whether you're looking to save, invest, or simply keep track of your spending, fintech offers tools that are not only innovative but also tailored to your needs. But what exactly is fintech, and why should you care? Let's dive into how fintech is transforming finance and what it means for you.

The Rise of Fintech: Why It Matters to Gen Z

Definition and Growth

Fintech, short for financial technology, refers to the integration of technology into financial services. While the concept has been around for decades, it has exploded in popularity over the past 15 years, thanks to the proliferation of smartphones and the internet. This surge in digital connectivity has allowed fintech companies to offer services that were once the exclusive domain of traditional banks.

According to a report by Columbia Business School, fintech experienced a "Cambrian explosion" with the advent of smartphones, allowing it to rapidly develop and meet the evolving needs of digital-first consumers【15†source】. Today, fintech is a multi-billion dollar industry, with companies offering everything from mobile banking and peer-to-peer payments to robo-advisors and cryptocurrency trading platforms.

Why It Resonates with Gen Z

For Gen Z, convenience and accessibility are paramount. This generation has grown up with technology at their fingertips, and they expect the same level of ease when it comes to managing their finances. Fintech platforms are designed with this in mind, offering intuitive, user-friendly interfaces that allow users to manage their money with just a few taps on their smartphone【15†source】【16†source】.

Moreover, Gen Z values transparency and ethical business practices. Many fintech companies are built on principles of openness, offering clear terms and conditions without the hidden fees often associated with traditional banks. This aligns perfectly with Gen Z's desire to engage with brands that reflect their values【8†source】.

How Gen Z is Using Fintech Today

Digital Payments

Digital payments are at the core of fintech’s offerings, encompassing mobile payment apps, online banking, and peer-to-peer payment systems like PayPal, Venmo, and Apple Pay. These services allow users to transfer money, pay bills, or make purchases with unprecedented speed and ease. In 2024, over 75% of Gen Z reported using mobile payment apps regularly, making digital payments an integral part of their financial lives【15†source】.

- Chart: Mobile Payment App Usage Among Gen Z (2024)

This chart shows the percentage of Gen Z users who regularly use mobile payment apps, highlighting the growing reliance on digital solutions for financial transactions.

Banking

Fintech has revolutionized traditional banking, giving rise to digital-only banks, also known as neobanks, which offer comprehensive banking services without the need for physical branches. These banks, like Chime and Monzo, allow users to manage their accounts, apply for loans, and even invest—all through a mobile app. This shift has made banking more accessible and convenient for Gen Z, who prefer digital interactions over in-person visits to bank branches【16†source】.

Lending

Online lending platforms have emerged as viable alternatives to traditional banks for securing personal loans, student loans, and small business loans. Companies like Upstart and LendingClub use technology to assess creditworthiness, often leveraging non-traditional data sources such as education and employment history. This approach allows for quicker loan approvals and more personalized lending options, making it easier for Gen Z to access credit【14†source】.

Investment and Wealth Management

Fintech has democratized investing with platforms like Robinhood, Acorns, and robo-advisors. These platforms enable users to start investing with minimal amounts of money, making the stock market accessible to everyone, not just the wealthy. Robo-advisors like Betterment use algorithms to manage portfolios, providing Gen Z with a hands-off approach to growing their wealth【14†source】.

- Graph: Growth in Robo-Advisor Adoption (2020-2024)

This graph illustrates the rapid growth in robo-advisor usage among Gen Z, underscoring the appeal of automated investment management.

Cryptocurrency and Blockchain

Cryptocurrencies like Bitcoin and Ethereum have become increasingly popular, particularly among Gen Z, who are drawn to the potential for high returns and the decentralized nature of these digital assets. Blockchain technology, which underpins cryptocurrencies, offers a secure and transparent way to record transactions, making it a promising tool for the future of finance. However, the volatile nature of cryptocurrencies requires careful consideration and a solid understanding of the risks involved【15†source】.

Insurance (Insurtech)

The insurance industry has not been left behind in the fintech revolution. Insurtech, or insurance technology, is transforming how insurance companies operate, from underwriting to claims processing. Innovative models like peer-to-peer insurance and on-demand insurance services are becoming more common, offering greater flexibility and tailored coverage options that appeal to Gen Z【16†source】.

Regtech

Regtech, or regulatory technology, helps financial institutions comply with regulations more efficiently. As financial services become more complex, regtech tools assist with data management, risk management, compliance, and reporting. This ensures that fintech companies can innovate while still adhering to necessary legal standards, balancing innovation with security【16†source】.

The Benefits: Why Fintech is a Game-Changer for Gen Z

Convenience and Accessibility

Fintech platforms are designed to be as convenient as possible, with many offering services that can be accessed 24/7 from any location with an internet connection. This is particularly beneficial for Gen Z, who are more likely to manage their finances on their smartphones than by visiting a bank branch【15†source】.

Moreover, fintech has the potential to bring financial services to underbanked populations. In regions where traditional banking infrastructure is lacking, fintech solutions like mobile banking and peer-to-peer payment platforms provide crucial access to financial services【16†source】.

Cost Savings

One of the key advantages of fintech is the reduction in fees and costs. Traditional banks often charge for everything from overdrafts to wire transfers. In contrast, many fintech companies offer these services at a fraction of the cost—or even for free. This is made possible by the lack of physical infrastructure and the use of automation, which significantly reduces overhead costs【14†source】.

- Chart: Comparison of Fees Between Traditional Banks and Fintech Platforms

This chart compares the fees associated with traditional banking services versus those offered by fintech platforms, highlighting the cost savings for consumers.

Innovation and Personalization

Fintech is at the forefront of financial innovation. From AI-driven financial advice to blockchain-based payments, these technologies are not only making financial services more efficient but also more personalized. For example, AI can analyze your spending habits and provide tailored advice on how to save more effectively【16†source】.

- Graph: Increase in AI-Driven Financial Services (2019-2024)

This graph shows the rise in the use of AI in financial services, particularly in areas like personalized financial advice and automated customer service.

The Drawbacks: What Gen Z Needs to Watch Out For

Privacy and Security Concerns

While fintech offers numerous benefits, it also comes with risks, particularly concerning data privacy and security. The digital nature of these platforms means that vast amounts of personal and financial data are stored online, making them a target for cyberattacks. Despite the advanced security measures that many fintech companies implement, data breaches remain a significant concern【14†source】.

- Chart: Number of Data Breaches in Fintech (2018-2024)

This chart illustrates the trend in data breaches affecting fintech platforms, highlighting the importance of robust security measures.

Digital Divide

While fintech has made financial services more accessible for many, it has also highlighted the digital divide. Not everyone has access to the internet or a smartphone, which are essential for using fintech services. This creates a barrier for certain populations, particularly in developing regions, potentially exacerbating financial inequality【14†source】.

Over-Reliance on Technology

The convenience of fintech can sometimes lead to over-reliance on technology. Automated processes, while efficient, can remove the personal touch that some consumers value. Additionally, the ease of accessing credit and making investments through fintech platforms can lead to impulsive financial decisions, which may not always be in the user's best interest【16†source】.

Practical Tips: How Gen Z Can Make the Most of Fintech

Stay Informed

Given the rapid pace of technological change, it's essential to stay informed about the fintech tools you're using. This means reading reviews, understanding the terms and conditions, and keeping up with industry news. Knowledge is power, and staying informed can help you make the most of fintech while avoiding potential pitfalls【16†source】.

Balance Convenience with Caution

While the convenience of fintech is undeniable, it's crucial to balance this with caution. Make sure you understand the risks associated with the services you use, particularly when it comes to data privacy and security. Always choose platforms that prioritize robust security measures and be vigilant about monitoring your accounts formonitoring your accounts for any suspicious activity【15†source】.

Explore and Experiment

Fintech offers a wide range of services, and it's worth exploring different platforms to find what works best for you. Whether you're interested in investing, budgeting, or simply managing your day-to-day finances, there's likely a fintech solution that meets your needs. Start small, especially if you're new to investing, and gradually build your confidence as you become more familiar with the tools available【8†source】.

Impact and Evolution of Fintech

Accessibility

Fintech has democratized access to financial services, making it possible for more people to participate in the financial system, including those in underbanked regions. With mobile banking and peer-to-peer payment platforms, individuals who previously had no access to traditional banking services can now manage their finances, receive payments, and even save and invest【15†source】.

Innovation

Continuous innovation in fintech is reshaping how we manage money. From AI-driven investment strategies to real-time fraud detection and blockchain technology, fintech is pushing the boundaries of what’s possible in the financial sector. These innovations are not only making financial services more efficient but also more secure and tailored to individual needs【16†source】.

Disruption

Traditional financial institutions have been significantly challenged by fintech startups. These startups, with their agile and user-centric approach, have forced traditional banks and financial services companies to adapt to the digital era or risk losing market share. This disruption is leading to more competition, which often results in better services and lower costs for consumers【14†source】.

Future Outlook

Fintech is expected to continue evolving, with advancements in AI, machine learning, blockchain, and other technologies further transforming the financial landscape. The future of fintech will likely see even more personalized financial services, greater integration of AI in decision-making processes, and the expansion of blockchain-based solutions【16†source】.

However, the interplay between regulation and innovation will be crucial. As fintech continues to grow, governments and regulators will need to balance fostering innovation with ensuring consumer protection and financial stability. This will involve developing new regulatory frameworks that can keep pace with the rapid advancements in technology【16†source】.

Conclusion

Fintech is more than just a buzzword—it's a powerful tool that can help you take control of your financial future. Whether you're looking to save money, invest wisely, or simply manage your day-to-day finances with greater ease, fintech has something to offer. However, as with any tool, it's essential to use it wisely. By staying informed, balancing convenience with caution, and exploring the wide range of options available, you can make the most of what fintech has to offer and set yourself up for long-term financial success.

BNPL: The Ultimate Shopping Hack or a Lowkey Financial Trap? 🤔💸

Yo, Gen Z fam! Gather 'round for some real talk about that trendy financial flex everyone's buzzing about – Buy Now, Pay Later (BNPL). Ever dreamed of copping that fire gadget, those sick kicks, or that Insta-worthy outfit without dropping a single coin upfront? Well, BNPL is here to make those dreams a reality. But hold up, is this financial wizardry actually legit for us, or is it just another way to catch us slipping? Let's dive deep and see if BNPL is our bestie or just another sus money move that'll have us crying into our avocado toast.

Why BNPL's Got Us Shook 🤯

It's Flex-friendly and Easy

Picture this: You're scrolling through your fave online store, and you spot THE perfect item. But the price tag's got you like 😱. Enter BNPL, swooping in like a financial superhero:

- No need for a solid credit score or those boring background checks your parents always stress about

- Quick approvals = instant gratification (we live for it!)

- Split payments make big purchases feel like NBD. It's like breaking down that group project into manageable chunks, but for your wallet

Real talk: BNPL services are giving us the financial flexibility we crave. It's like having a cool aunt who lends you money without the awkward "when are you paying me back?" convo every family dinner.

Bye Felicia to Traditional Credit Cards 👋

Let's be honest, credit cards give us major anxiety:

- We've seen our parents struggle with credit card debt – no thanks, we're not trying to repeat that trauma

- BNPL feels safer with its low/no interest rates (if you pay on time, obvs)

- Clear payment schedules > confusing credit card jargon that feels like it's written in an alien language

BNPL is like the chill alternative to those scary credit cards. It's giving us "I've got my life together" vibes without the stress of potentially drowning in high-interest debt.

Digital Vibes Only 📱

We're the digital natives, and BNPL gets that:

- Seamlessly integrated into our fave online shops – it's smoother than your favorite face filter

- Mobile apps for on-the-go money management (because who has time to sit at a desktop?)

- Shop straight from Insta and TikTok? Yes, please! It's like our social media addiction and shopping habits had a baby, and it's beautiful

BNPL fits into our lives like that one perfect emoji that just gets the vibe. It's not trying to change how we shop; it's adapting to our digital-first lifestyle.

The Glow-Up: BNPL Pros ✨

Interest-free Payments (If You're On Top of Your Game)

Imagine borrowing money without the extra costs. That's BNPL when you play by the rules:

- Make your payments on time, and you're golden – no extra fees, no interest, nada

- It's like having a mini, interest-free loan for each purchase

- Perfect for when you need something now but payday's still a week away (we've all been there)

- Simple AF to Understand

No Ph.D. in finance needed here:

- Clear terms that don't make your brain hurt

- Transparent payment schedules – you know exactly what you owe and when

- No hidden fees lurking in the fine print (unlike those sus terms and conditions we never read)

It's refreshing to deal with financial stuff that doesn't require a translator or a law degree to understand.

Easier to Get Approved Than Those Stuffy Credit Cards

For those of us still building our credit (or, let's be real, haven't even started):

- Minimal credit checks mean you're more likely to get approved

- Great for students or anyone new to the whole "financial responsibility" thing

- Can help you start building a positive credit history (if the BNPL service reports to credit bureaus)

It's like BNPL is giving us training wheels for the world of credit. We can start small and work our way up to the big leagues.

The Glow-Down: BNPL Cons 😬

Debt Can Sneak Up on You Faster Than a TikTok Trend

Here's where things can get messy:

- Multiple BNPL purchases can add up quicker than your screen time

- Before you know it, you're juggling payments like a circus act

- That "affordable" monthly payment suddenly doesn't look so cute when it's multiplied by 5

It's easy to lose track and end up with more financial obligations than you can handle. Suddenly, you're choosing between paying for your BNPL purchases or buying groceries – not a vibe.

Less Protection Than Credit Cards If Things Go South

When things don't go as planned, BNPL might leave you hanging:

- Dispute resolution can be trickier than with credit cards

- Some consumer protections you get with credit cards might not apply

- If you need to return something, you might still be on the hook for payments

It's like going to a party without your squad – if drama goes down, you're on your own.

Might Make You Splurge on Stuff You Don't Really Need

Let's be real, we've all been there:

- The temptation to buy things just because you can is REAL

- "Four easy payments" make everything seem affordable (even when it's not)

- You might end up with a closet full of impulse buys and an empty bank account

BNPL can turn us all into that meme of the dog surrounded by fire saying "This is fine." Spoiler: It's not fine.

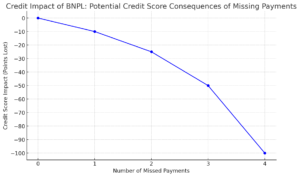

Late Payments Can Mess Up Your Credit Score Big Time

Miss a payment, and things can go downhill fast:

- Late fees can stack up quicker than likes on a viral post

- Some BNPL services report late payments to credit bureaus

- A few missed payments could tank your credit score before you even have a chance to build it

It's like getting detention in high school – it goes on your permanent record, and it's not a good look.

What's the Tea with Gen Z? ☕

At first, we were all about that BNPL life. It was the cool new way to shop, and everyone was doing it. But now? The vibes are shifting, and we're getting kinda sus.

The Initial Hype

When BNPL first hit the scene, it was like:

- "OMG, I can buy whatever I want without waiting? Sign me up!"

- "No credit card? No problem! BNPL's got my back."

- "It's like magic – I get the stuff now and worry about paying later."

We were living our best lives, snagging deals left and right, and feeling like financial geniuses.

The Reality Check

But as time went on, some of us started noticing:

- Those "easy payments" weren't always so easy when they all came due at once

- Friends were stressing about keeping up with multiple BNPL obligations

- Horror stories of BNPL debt started popping up on social media

Now, we're approaching BNPL with more caution. It's still convenient AF, but we're more aware of the potential pitfalls.

The New Mindset

These days, the Gen Z vibe around BNPL is more:

- "Yeah, it's cool, but you gotta be smart about it."

- "I only use it for big purchases I've planned for."

- "It's not free money – you still gotta pay it back, fam."

We're not totally ditching BNPL, but we're definitely more cautious. It's like we've collectively realized that with great purchasing power comes great financial responsibility (thanks, Spider-Man's uncle).

How to Use BNPL Without Clowning Yourself 🤡

Alright, so you've decided to dip your toes into the BNPL pool. Here's how to swim without sinking:

1. Set a Budget and Stick to It Like Your Fave Skincare Routine

- Figure out how much you can actually afford to spend each month

- Include your BNPL payments in your budget – they're real expenses, not Monopoly money

- Use a budgeting app to keep track of everything (because who does math manually anymore?)

2. Track Your Payments Like You Track Your Crush's Instagram Activity

- Set reminders for when payments are due – use your phone, a planner, whatever works

- Check your BNPL accounts regularly – make it part of your daily scroll routine

- If you've got multiple BNPL accounts, create a spreadsheet to keep track (yes, we're getting that serious)

3. One BNPL Plan at a Time – Don't Be Greedy!

- Resist the urge to open multiple BNPL accounts – it's not Pokémon, you don't need to catch 'em all

- Finish paying off one purchase before starting another

- If you're tempted, ask yourself: "Do I really need this, or am I just bored?"

4. Actually Read the Terms (Yeah, It's Boring, But So Is Being Broke)

- Take five minutes to understand what you're signing up for

- Look for info on late fees, interest rates, and what happens if you miss a payment

- If something's not clear, ask! There's no such thing as a stupid question when it comes to your money

5. Consider Saving Up Instead – Old School, But It Works

- For non-essential purchases, try the radical idea of saving up first

- Set up a separate savings account for your shopping goals

- Challenge yourself to save the BNPL amount before buying – if you can't, maybe it's not the right time

Alternatives to BNPL (Because Options are Everything)

Not feeling the BNPL vibe? No worries, there are other ways to flex your financial muscles:

1. Save Up Like Your Grandparents Did (Vintage is In, Right?)

- Open a high-yield savings account and watch your money grow (slowly, but still)

- Set up automatic transfers to your savings account – it's like putting your savings on autopilot

- Use apps that round up your purchases and save the difference – painless saving FTW

2. Use a Debit Card and Avoid Debt Altogether

- It's simple: if the money's not in your account, you can't spend it

- Some debit cards offer rewards now, so you're not missing out on those sweet, sweet points

- Pro tip: use a separate checking account for spending to avoid accidentally emptying your main account

3. If You Must, Look Into Low-Interest Credit Cards with Better Protection

- Do your research and find cards with low or no annual fees

- Look for intro offers with 0% APR – it's like BNPL but with more flexibility

- Remember: credit cards are serious business, so read ALL the terms and conditions

4. Explore Cashback and Rewards Apps

- Use apps that give you cashback on your purchases – it's like getting paid to shop

- Look for browser extensions that automatically apply coupons – never overpay again

- Stack rewards by using these apps with your regular debit or credit card purchases

The Final Tea ☕

Alright, fam, let's wrap this up. BNPL can be a total vibe if you use it smart. It's got some serious perks – like helping you manage your cash flow and avoid credit card debt. But it's also got some major red flags if you're not careful.

Before you jump on the BNPL bandwagon, take a hot sec to think about your financial goals:

- Can you really afford those payments, or are you just caught up in the hype?

- Is this purchase something you need, or are you just trying to keep up with the Joneses (or the TikTokers)?

- Would you be better off saving up and buying outright?

Remember, just because you can buy now doesn't mean you should. Your future self will thank you for being financially savvy now. Stay woke about your finances, and don't let BNPL become your financial Achilles' heel.

At the end of the day, BNPL is just a tool. Like any tool, it can be super helpful or lowkey dangerous, depending on how you use it. So use it wisely, stay informed, and keep your financial goals in mind.

Extra Resources to Level Up Your Money Game 📚

Want to dive deeper into the world of personal finance? Check out these resources:

- Consumer Financial Protection Bureau (CFPB): They've got some real talk about credit, debt, and your rights as a consumer. It's like having a financial big sibling looking out for you.

- National Endowment for Financial Education (NEFE): These folks are all about helping you budget, save, and make smart money moves. Their resources are perfect for financial newbies.

- YouTube Channels: Check out channels like "The Financial Diet" or "Aja Dang" for relatable, Gen Z-friendly financial advice.

- Podcasts: "Bad With Money with Gaby Dunn" and "Millennial Money" are great for diving into money topics while you're on the go.

- Subreddits: r/personalfinance and r/povertyfinance have active communities discussing everything from budgeting to investing.

BNPL Face-Off: Affirm vs. Afterpay vs. Klarna

Curious about the differences between popular BNPL services? Here's a quick rundown:

Affirm

- Flexible payment options (3, 6, or 12 months)

- Some plans have interest, so watch out for that

- Reports to credit bureaus (could help build your credit if you're responsible)

Afterpay

- Always interest-free (if you pay on time)

- Four equal payments over 6 weeks

- Strict deadlines – don't sleep on those payments!

Klarna

- Offers both "Pay in 4" (interest-free) and longer-term financing options

- Some plans have interest, so choose wisely

- Has a shopping app with exclusive deals (tempting, but dangerous if you're not careful)

Each has its own vibe, so do your homework before committing to one.

Let's Keep the Convo Going!

So, what's your take on BNPL? Has it been your financial BFF or more trouble than it's worth? Drop your thoughts in the comments! 💬

- Have you used BNPL before? How was your experience?

- Any tips for using BNPL responsibly that we missed?

- What other financial topics do you want us to break down next?

Let's learn from each other and level up our financial game together. Remember, we're all just trying to figure out this adulting thing, so no judgment here!

Stay smart, stay savvy, and keep slaying those financial goals, fam! 💪💰

Buy Now, Pay Later: Is It a Smart Choice for Gen Z

Imagine buying your favorite gadget today without paying a cent upfront—sounds too good to be true? Welcome to the world of Buy Now, Pay Later (BNPL), where instant gratification meets modern finance. In today's fast-paced world, the ability to purchase items instantly and defer payment has revolutionized consumer behavior. BNPL services have become a popular payment method, particularly among younger generations. But while BNPL offers undeniable convenience, it's important to ask: Is it a smart financial choice for Gen Z? This post will delve into the pros and cons of BNPL for young consumers, exploring whether this financial tool is a friend or foe.

The Appeal of BNPL to Gen Z

Financial Flexibility and Accessibility: BNPL services provide Gen Z with the financial flexibility they crave. Unlike traditional credit systems, which often require extensive background checks and a solid credit history, BNPL allows for quick and easy access to credit. This is particularly appealing to younger consumers who may not have established credit yet. With quick approvals, minimal credit checks, and payments broken down into small, manageable chunks, BNPL allows Gen Z to purchase items without feeling the financial strain upfront. This aligns with their need for financial autonomy and control, enabling them to enjoy products immediately while managing their budget over time.

- BNPL services often offer promotional deals or interest-free periods, making high-ticket items more affordable for Gen Z.

- This payment method can help Gen Z build a positive credit profile when linked with credit bureaus, offering a pathway to establishing credit.

- The ability to manage payments over time supports their broader financial goals, such as saving for other important expenses without immediate compromise.

Avoidance of Traditional Credit: Having witnessed the pitfalls of traditional credit, such as high-interest rates and the risk of revolving debt, many Gen Z consumers are wary of credit cards. The 2008 financial crisis left a lasting impression, making them cautious about incurring large amounts of debt. BNPL offers an alternative that seems safer and more controlled, with lower or no interest rates as long as payments are made on time. This perceived safety net makes BNPL an attractive option for those looking to avoid the dangers associated with traditional credit.

- Many BNPL providers send reminders and offer flexible payment options, reducing the risk of late payments and associated fees.

- By using BNPL instead of credit cards, Gen Z can avoid the temptation of spending beyond their means, as BNPL often limits purchases to manageable amounts.

- The transparency of BNPL terms, with clear payment schedules and fees, contrasts with the often complex and opaque nature of credit card agreements, building trust among younger consumers.

Digital-Native Convenience: Gen Z, the first generation to grow up fully immersed in digital technology, values seamless and integrated experiences. BNPL fits perfectly into their online shopping habits, with services often embedded directly into e-commerce platforms. This integration allows for a smooth and effortless checkout process, enhancing the overall shopping experience. Furthermore, with mobile accessibility through apps, BNPL services cater to Gen Z’s mobile-first lifestyle, allowing them to manage their finances on the go.

- BNPL options are frequently integrated into social media shopping experiences, allowing Gen Z to purchase directly from platforms like Instagram or TikTok.

- These services often include user-friendly dashboards that allow Gen Z to track spending, upcoming payments, and budget insights in real-time.

- The ability to sync BNPL services with digital wallets and payment apps enhances the ease of use and aligns with Gen Z’s preference for streamlined financial management tools.

The Pros of Using BNPL

No-Interest Payments: One of the most significant advantages of BNPL is the ability to make interest-free purchases, provided payments are made according to the plan. This can be a major benefit for consumers who need to manage cash flow without incurring additional costs. For those who are disciplined in their payments, BNPL offers a cost-effective alternative to credit cards, which often carry high-interest rates if balances are not paid off immediately.

Simplicity and Predictability: BNPL services are designed with simplicity and transparency in mind. Fixed payment plans are straightforward, making it easier for consumers to budget and plan their finances. Unlike credit cards, which can accrue interest over time, BNPL agreements typically have clear terms with no hidden fees, as long as payments are made on time. This predictability can be particularly appealing to Gen Z, who may be new to managing finances and prefer clear, easy-to-understand financial commitments.

Easier Approval Process: For young consumers with little or no credit history, obtaining a traditional credit card can be challenging. BNPL services provide an alternative with a more accessible approval process. With minimal credit checks and a quick application process, BNPL allows consumers to access the products they want without the hurdles associated with traditional credit.

The Cons of Using BNPL