Snowball Your Way to Financial Freedom: A Gen Z Guide to Crushing Debt

Yo, fellow broke millennials and Gen Z-ers! Feeling like you're stuck in a financial Squid Game, but without the cash prize at the end? Drowning in student loans, credit card bills, and that impulse purchase you made after binge-watching "Selling Sunset"? Don't sweat it, fam – we've all been there. Let's chat about how to dig yourself out of that money pit using the Debt Snowball Method. It's like KonMari-ing your finances, but instead of asking if things spark joy, we're asking if they're sucking your wallet dry. And who better to guide us through this than the OG of getting out of debt, Dave Ramsey?

Debt: The Ultimate Vibe Killer

Before we dive into Dave's wisdom, let's spill the tea about why debt is more toxic than your ex's Instagram stories:

- Student Loans: The gift that keeps on taking. You thought that degree would lead to a corner office, but here you are, eating instant ramen in your childhood bedroom.

- Credit Card Debt: Remember that time you said "YOLO" and booked a trip to Coachella? Yeah, your credit score remembers too.

- Personal Loans: Whether it's for your side hustle or that emergency wisdom teeth removal, these loans are as clingy as that person you drunk-texted once.

The impact? It's not just about the Benjamins, folks:

- Mental Health: Constant anxiety about checking your bank account is not the glow-up we're looking for.

- Life Goals: Want to move out, travel the world, or start that podcast about true crime and houseplants? Debt's standing in your way like a bouncer at the club you're too broke to get into anyway.

- Future You: While you're struggling to make minimum payments, your retirement savings are looking as empty as your DMs during a pandemic.

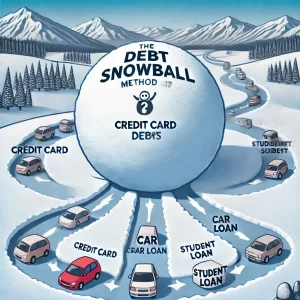

Enter the Debt Snowball Method: Dave Ramsey's Secret Sauce

Okay, so what's this Snowball thing that Dave Ramsey is always hyping? It's not a new TikTok dance challenge (although maybe it should be). The Debt Snowball Method is a genius way to pay off your debts that'll keep you more motivated than a double shot espresso.

Here's the 411, straight from Dave's playbook:

- List all your debts from smallest to largest. (No cheating – your ego isn't a debt, even if it's huge.)

- Pay the minimum on everything (because adulting).

- Throw any extra cash at the smallest debt.

- Once that's gone, move to the next smallest. Rinse and repeat.

It's like playing Candy Crush, but instead of lining up colorful candies, you're crushing debts. Sweet!

Snowball vs. Avalanche: The Ultimate Debt-Slaying Showdown

Now, you might have heard of another method – the Debt Avalanche, championed by Suze Orman (you know, that financial guru your mom follows on Facebook). Let's break down the difference:

- Debt Avalanche (Suze's Jam):

- Pay off highest interest rates first, regardless of balance.

- Pros: Saves you more money in the long run, like choosing the salad over fries (but who really does that?).

- Cons: Might take longer to see visible progress, especially if your highest-interest debt is also your largest.

- Debt Snowball (Dave's Choice):

- Pay off smallest debts first, regardless of interest rate.

- Pros: Quick wins that feel good, like getting a match on a dating app (that actually messages you back).

- Cons: You might pay more in interest over time, but hey, motivation is priceless.

Dave Ramsey champions the Snowball method because it's psychologically superior. It's like choosing between a flashy TikTok dance (Snowball) and a complicated yoga routine (Avalanche) – the dance might not be as intense, but you're more likely to stick with it and show it off to your friends.

Snowball Method: A Step-by-Step Guide for the Financially Challenged

Let's break down Dave's strategy:

- Get Organized: List your debts like you're planning the ultimate music festival lineup. Use a spreadsheet, an app, or go old school with pen and paper (just don't use the back of an overdue bill).

- Minimum Payments are Your New BFF: Pay the minimum on everything. It's like maintaining streaks on Snapchat – gotta keep that momentum.

- Find Your Starter Pokémon: Identify the smallest debt. That's your first target.

- Channel Your Inner Gamer: Any extra cash goes to defeating that small debt. Think of it as power-ups in your debt-busting game.

- Rinse and Repeat: Once you've conquered one debt, move on to the next smallest. It's like leveling up, but for your bank account.

Pro Tips from the Money Maestro: Dave Ramsey

Dave Ramsey is like the cool uncle of finance, if your cool uncle was really into budgeting and yelling "Live like no one else, so later you can live like no one else!" Here's what he'd tell you over a cup of homemade coffee (because Starbucks is for people not serious about their debt):

- Stay Gazelle Intense: Treat your debt repayment plan like you're a gazelle running from a cheetah. The cheetah is debt, and it wants to eat your future.

- Cash is King: Use the envelope system for budgeting. It's like meal prepping, but for your money.

- No New Debt: Credit cards are like that ex you keep going back to. Cut them up, block their number, and move on.

- Side Hustle Hard: Get a part-time job or start a side gig. Your free time is now making-money time.

Real People, Real Success: Dave-Approved Stories

Let's look at some folks who crushed it with the Snowball Method, making Dave proud:

Emma's Epic Win: Demolished $10K in credit card debt in 18 months. How? Cut out unnecessary subscriptions (goodbye, 7th streaming service) and started a side hustle selling vintage finds on Depop.

Liam's Loan Takedown: Wiped out student loans in three years by living on rice and beans (literally) and turning their dog-walking gig into a full-fledged pet-sitting empire on Rover.

Gamify Your Debt Repayment: Dave Ramsey Meets Fortnite

Make paying off debt as addictive as scrolling through TikTok:

- Create Milestones: Set small goals and reward yourself (in budget-friendly ways) when you hit them. Dave would approve of a victory dance in your living room.

- Visualize Progress: Use debt payoff apps or create a visual chart. Watching that debt shrink is more satisfying than popping bubble wrap.

- Challenge Friends: Start a debt payoff challenge with friends. First one to pay off a certain amount gets treated to a home-cooked meal (because restaurants are for the weak, according to Dave).

Staying Motivated When the FOMO Hits

Let's be real – paying off debt while your friends are living it up on Instagram can be tougher than explaining NFTs to your grandma. Here's how to keep your eyes on the prize, Dave Ramsey style:

- Reframe Your Mindset: Think of debt payoff as investing in your future self. Future you will be thanking present you for those sacrifices (and probably for not buying those NFTs).

- Find Free Fun: Get creative with free activities. Nature hikes, free museum days, or hosting potluck game nights can be just as gram-worthy as that overpriced brunch.

- Celebrate Small Wins: Paid off $100? That's worth a celebration! Do a happy dance, post a humble brag, or treat yourself to a fancy coffee (but just one, Dave is watching with disapproval!).

Beyond Debt: Building Your Financial Empire

Once you've slayed your debt dragon, it's time to level up your money game. Here's what Dave Ramsey would want you to do next:

- Emergency Fund: Start building that safety net. Aim for 3-6 months of expenses, or enough to survive the zombie apocalypse (whichever comes first).

- Invest in Yourself: Consider low-cost ways to boost your skills. Online courses, workshops, or certifications can increase your earning potential faster than you can say "multi-level marketing scheme" (which, by the way, Dave would tell you to avoid like the plague).

- Start Investing: Even small amounts in index funds can grow over time. It's like planting seeds for your future money tree, but less work than actual gardening.

- Give Back: Once you're debt-free and building wealth, remember to be generous. It's good karma, and it'll make you feel richer than any designer label could.

Drop the Mic: Final Thoughts

Crushing debt isn't just about the numbers – it's about taking control of your life and building the future you want. The Debt Snowball Method, championed by Dave Ramsey, is your secret weapon in this financial boss battle.

Remember, every payment is a step towards freedom. It might not be as instantly gratifying as getting likes on your latest post, but trust us, the long-term payoff is way better than any fleeting social media dopamine hit.

So, are you ready to start your debt snowball and roll your way to financial freedom? Drop a comment, share your goals, or hit us up with your best debt-crushing memes. Let's turn that financial frown upside down and make Dave Ramsey proud!

#DebtFreeJourney #SnowballMethod #GenZMoney #DaveRamseyWouldBeProud