Conquering Debt: Suze Orman’s Debt Avalanche Method

Debt can be an overwhelming mountain to climb, especially when it feels like you're barely making a dent. For those looking to pay off debt efficiently, the Debt Avalanche Method offers a financially sound strategy. Championing this approach is Suze Orman, a renowned financial advisor known for her practical and empowering financial advice. In this post, we'll explore Suze Orman's philosophy and how the Debt Avalanche Method can help you achieve financial freedom.

Understanding Debt and Its Impact

Debt comes in many forms and can significantly impact various aspects of life. Some of the most common types of debt include:

- Student Loans: These can be a huge burden right out of college, affecting your ability to save and invest early.

- Credit Card Debt: Often results from high-interest rates and can quickly spiral out of control if not managed properly.

- Personal Loans: Taken out for big purchases or emergencies, these can add up and lead to financial strain.

The impact of debt extends beyond just financial stress. It can affect:

- Mental Health: Constant worry about debt can lead to anxiety and depression.

- Lifestyle Choices: High debt can limit your ability to make significant life choices like buying a home, traveling, or starting a family.

- Future Financial Goals: The more debt you have, the harder it is to save for retirement or invest in opportunities that could grow your wealth.

Understanding the full impact of debt underscores the importance of taking control of your financial situation early and effectively.

The Impact of Financial Stress on Mental Health Among Generation Z

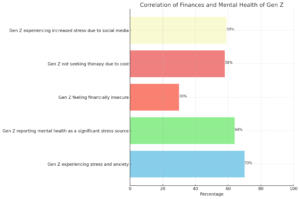

This graph illustrates the correlation between financial factors and mental health among Generation Z. It shows the percentages of Gen Z individuals affected by various stressors:

- 70% of Gen Z experience stress and anxiety, reflecting overall mental health challenges.

- 64% report that their mental health has been a significant source of stress in the past year.

- 30% feel financially insecure, highlighting the impact of financial stress.

- 58% do not seek therapy due to the high cost, indicating financial barriers to mental health care.

- 59% experience increased stress and anxiety due to social media, which often exacerbates financial concerns.

This data underscores the significant interplay between financial stress and mental health issues within this generation.

What is the Debt Avalanche Method?

The Debt Avalanche Method is a debt repayment strategy that prioritizes paying off debts with the highest interest rates first. This approach aims to minimize the amount of interest paid over time, making it a more financially efficient method compared to other strategies like the Debt Snowball Method, which focuses on paying off the smallest debts first for quick wins.

Contrast with the Debt Snowball Method:

- Debt Snowball: Prioritizes smallest debt balances for quick psychological wins.

- Debt Avalanche: Prioritizes highest interest rates to minimize total interest paid and accelerate debt repayment.

Steps to Implement the Debt Avalanche Method

- List Your Debts: Create a detailed list of all your debts, including balances and interest rates. Tools like Excel, Google Sheets, or budgeting apps can be helpful.

- Make Minimum Payments: Ensure you make minimum payments on all your debts to stay current and avoid penalties.

- Focus on the Highest Interest Debt: Allocate any extra funds towards paying off the debt with the highest interest rate first. This strategy reduces the total interest paid over time.

- Repeat the Process: Once the highest interest debt is paid off, move on to the next highest interest debt with the freed-up funds. Continue this process until all debts are paid off.

Benefits of the Debt Avalanche Method

- Financial Savings: By focusing on high-interest debts, you minimize the total interest paid, saving money in the long run.

- Faster Debt Repayment: Reducing interest payments accelerates the overall debt repayment process.

- Long-Term Financial Health: This method promotes long-term financial stability and efficiency, setting you up for a debt-free future.

Financial Savings Over Time: Debt Avalanche Method vs. No Method

This line graph illustrates the financial savings achieved over a period of 24 months using the Debt Avalanche Method compared to having no structured debt repayment method.

Key Points:

- Debt Avalanche Method: The line marked with circles shows the total savings when following the Debt Avalanche Method. This method prioritizes paying off debts with the highest interest rates first, resulting in significant savings on interest over time.

- No Structured Method: The line marked with crosses represents the savings when no specific debt repayment strategy is used. The savings grow at a slower pace due to higher interest payments on outstanding debts.

By following the Debt Avalanche Method, individuals can save more money over time compared to not using a structured debt repayment plan. This visual comparison underscores the financial efficiency and benefits of the Debt Avalanche Method in reducing overall debt more quickly and saving on interest costs.

Tips from Suze Orman

Suze Orman offers a wealth of advice for those looking to manage their debt efficiently. Here are some of her key tips:

- Stay Disciplined: Consistency is crucial. Stick to your debt repayment plan and avoid taking on new debt.

- Educate Yourself: Knowledge is power. Understand your debts, interest rates, and financial options.

- Track Your Progress: Regularly review your debts and progress. Use apps and tools to stay organized and motivated.

- Seek Support: Share your goals with friends, family, or online communities for encouragement and accountability.

Real-Life Success Stories

Here are a couple of inspiring stories from individuals who have successfully used the Debt Avalanche Method:

- Alex: Paid off $15,000 in credit card debt in two years by focusing on high-interest debts. By cutting unnecessary expenses and taking on freelance work, Alex accelerated his debt repayment.

- Jordan: Eliminated student loans in four years by prioritizing the highest interest rates first. Jordan's disciplined approach and extra payments from a side hustle significantly reduced overall interest costs.

Lessons Learned:

- Focusing on high-interest debts saves money.

- Extra income sources can accelerate debt repayment.

- Staying disciplined and motivated is key to success.

Comparing Debt Avalanche to Debt Snowball

While both methods aim to help you get out of debt, they do so in different ways:

- Debt Avalanche Method (Suze Orman):

- Focuses on paying off debts with the highest interest rates first.

- Minimizes total interest paid over time.

- Financially efficient but may take longer to see psychological wins.

- Debt Snowball Method (Dave Ramsey):

- Focuses on paying off the smallest debts first.

- Provides quick psychological wins to maintain motivation.

- May result in paying more interest over time compared to the Debt Avalanche Method.

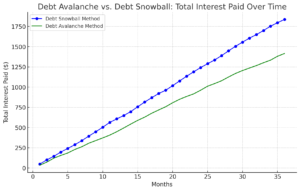

Debt Avalanche vs. Debt Snowball: Total Interest Paid Over Time

This graph compares the Debt Avalanche Method and the Debt Snowball Method in terms of total interest paid over a period of 36 months. The blue line represents the Debt Snowball Method, which prioritizes paying off the smallest debts first. The green line represents the Debt Avalanche Method, which focuses on paying off debts with the highest interest rates first.

Key Takeaways:

- Debt Snowball Method: While this method offers quick psychological wins by eliminating smaller debts first, it generally results in higher total interest paid over time.

- Debt Avalanche Method: This method minimizes the total interest paid by focusing on high-interest debts first, leading to greater long-term financial savings.

By following the Debt Avalanche Method, you can reduce the amount of interest paid and accelerate your journey to becoming debt-free.

Take Control of Your Financial Future

The Debt Avalanche Method, championed by Suze Orman, offers a powerful strategy for managing debt efficiently. By prioritizing high-interest debts, you can save money on interest and pay off your debts faster. Consider implementing this method to take control of your financial future.

Take the first step today by listing all your debts and making a plan to tackle the highest interest one. Share your progress, leave comments with questions or success stories, and follow our blog for more financial tips and advice.