How you Can Use Dave Ramsey’s Debt Snowball Method to Crush Debt

Are you feeling overwhelmed by debt? Whether it's student loans, credit card bills, or personal loans, managing debt can be a daunting task. But don't worry, there's a strategy that can help you take control of your finances and achieve financial freedom. It's called the Debt Snowball Method, popularized by financial expert Dave Ramsey. In this post, we'll break down what it is, why it's effective, and how you can use it to crush your debt.

Understanding Debt and Its Impact

Debt comes in many forms, and for many, the most common types include:

- Student Loans: These can be a huge burden right out of college.

- Credit Card Debt: Easy to accumulate but hard to pay off.

- Personal Loans: Often taken out for big purchases or emergencies.

Debt can have a significant impact on your mental health, lifestyle, and future goals. It's essential to take control of your financial situation early to avoid long-term stress and limited opportunities.

What is the Debt Snowball Method?

The Debt Snowball Method, championed by Dave Ramsey, is a debt repayment strategy where you focus on paying off your smallest debts first to build momentum. Unlike other methods that prioritize high-interest debts, this approach leverages psychological wins to keep you motivated.

Why is it effective?

- Psychological Boost: Quick wins keep you motivated.

- Momentum: Each debt paid off frees up more money to tackle the next one.

- Behavioral Focus: Encourages disciplined spending and repayment habits.

Steps to Implement the Debt Snowball Method

- List Your Debts:

- Create a comprehensive list of all your debts from smallest to largest balance.

- Use tools like Excel, Google Sheets, or budgeting apps to keep track.

- Make Minimum Payments:

- Ensure you stay current on all your debts by making minimum payments.

- Budgeting apps like Mint or YNAB can help manage this.

- Focus on the Smallest Debt:

- Allocate any extra money towards paying off the smallest debt first.

- Find ways to increase your income or cut expenses, such as side hustles or reducing discretionary spending.

- Repeat and Gain Momentum:

- Once the smallest debt is paid off, move to the next smallest debt with the freed-up funds.

- Celebrate small wins to stay motivated.

Comparing Debt Repayment Strategies: Debt Snowball vs. Minimum Payments

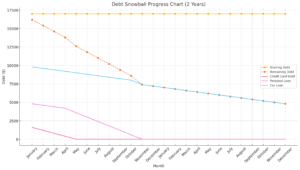

Debt Snowball Progress Chart (2 Years)

- Approach: Pay off smallest debts first.

- Overall Trend: Rapid debt reduction.

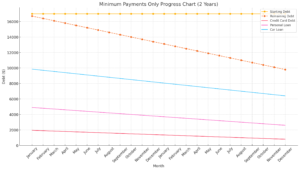

Minimum Payments Only Progress Chart (2 Years)

- Approach: Make only minimum payments.

- Overall Trend: Slow debt reduction

Key Takeaways

- Debt Snowball Method:

- Pros: Faster debt reduction, psychological boosts.

- Cons: Potentially higher interest costs.

- Minimum Payments Only:

- Pros: Simplicity, lower immediate burden.

- Cons: Slow progress, higher long-term costs.

The debt snowball method is better for quickly reducing debt and staying motivated.

Tips for Staying on Track

- Avoid Common Pitfalls: Resist the temptation of lifestyle inflation and avoid taking on new debt.

- Create a Support System: Share your goals with friends, family, or online communities for encouragement.

- Track Your Progress: Regularly review your debts and adjust your strategy as needed.

Leveraging Technology and Resources

Use technology to your advantage with apps and tools designed to help manage and pay off debt:

- Debt Payoff Planner: Helps you create a debt payoff plan and track your progress.

- Mint: Offers budgeting tools and expense tracking.

- YNAB (You Need A Budget): Helps you allocate every dollar and stay on top of your finances.

Follow financial influencers and educators who provide ongoing tips and motivation, such as Dave Ramsey, The Financial Diet, or YouTube channels focused on personal finance.

Real-Life Success Stories

Here are a couple of stories from Gen Z individuals who have successfully used the Debt Snowball Method:

- Emma: Paid off $10,000 in credit card debt in 18 months by focusing on her smallest debts first and using a side hustle to increase her income.

- Liam: Eliminated his student loans in three years by cutting down on non-essential expenses and using the Debt Snowball Method to stay motivated.

Lessons Learned:

- Small wins build confidence.

- Extra income sources can accelerate the debt payoff process.

- Staying disciplined and motivated is key.

Comparing Debt Snowball to Debt Avalanche

While both methods aim to help you get out of debt, they do so in different ways:

- Debt Snowball Method (Dave Ramsey):

- Focuses on paying off the smallest debts first.

- Provides quick psychological wins to maintain motivation.

- May result in paying more interest over time compared to the Debt Avalanche Method.

- Debt Avalanche Method (Suze Orman):

- Focuses on paying off debts with the highest interest rates first.

- Minimizes total interest paid over time.

- Financially efficient but may take longer to see psychological wins.

The Debt Snowball Method is a powerful tool to help you gain control over your finances and achieve financial freedom. By focusing on paying off your smallest debts first, you can build momentum and stay motivated throughout your debt repayment journey.

Take the first step today by listing all your debts and making a plan to tackle the smallest one. Share your progress, leave a comment with your questions or success stories, and follow our blog for more financial tips and advice.

Additional Resources

For personalized advice or coaching, contact us at [Your Contact Information].